Sanctions compliance is not new — yet for years it has lived in the shadows of AML. Regulators talked about it, firms documented it, but what happens in reality?

Very few institutions truly tested their capabilities, challenged their controls, or understood their exposure. The European Banking Authority (EBA), in its 2024 Guidelines on this topic, points to a clear imbalance: sanctions compliance is applied very inconsistently across Europe. And the timing is no coincidence. With geopolitical tensions rising, digital assets expanding, and crypto becoming a mainstream financial channel, sanctions have shifted from a legal formality to a frontline defense tool. We have now entered a new era — one where sanctions compliance must become practical, actionable and measurable, not theoretical.

Luxembourg is not entering this race from behind. Recent assessments from ESMA praise the CSSF as one of the more rigorous supervisors in Europe, particularly in the oversight of outsourcing and risk governance. Yet with CSSF Circular 25/896, Luxembourg is choosing not to rest on good results — it is raising the bar.

What used to be a quiet back-office responsibility is now a Board-level strategic discipline. The ability to freeze assets accurately and without delay is rapidly becoming as critical as liquidity buffers or capital ratios. In this new environment, Boards are no longer spectators — they are decision-makers, accountable and expected to lead.

A Shift From Compliance Task to Strategic Discipline

The new Circular transposes two major EBA Guidelines — EBA/GL/2024/14 and EBA/GL/2024/15 — into a binding national framework. For the first time in Europe, sanctions compliance receives the same structural attention as prudential risk, pushing institutions to rethink how they organise governance, IT systems, risk exposure assessments and internal controls.

What drives this change is not bureaucracy; it is reality. Sanctions have become a key geopolitical tool, shaping global stability and financial integrity. Transactions travel across borders in milliseconds, and loopholes travel even faster. Without consistent and timely enforcement, sanctions lose their power. Europe has learned this through experience: more than 6,000 open investigations and over 1,500 convictions for sanctions violations demonstrate how urgent it is to act.

The message is unmistakable: improvisation is no longer acceptable.

Boards at the Centre of the Mandate

The Circular establishes a clear accountability framework: the Board owns sanctions compliance. It must approve strategy, allocate resources, document and review exposure assessments and challenge the control framework. A senior staff member — often the Compliance Officer — becomes responsible for coordinating implementation and reporting directly to the Board. Tasks may be delegated, but responsibility cannot be transferred.

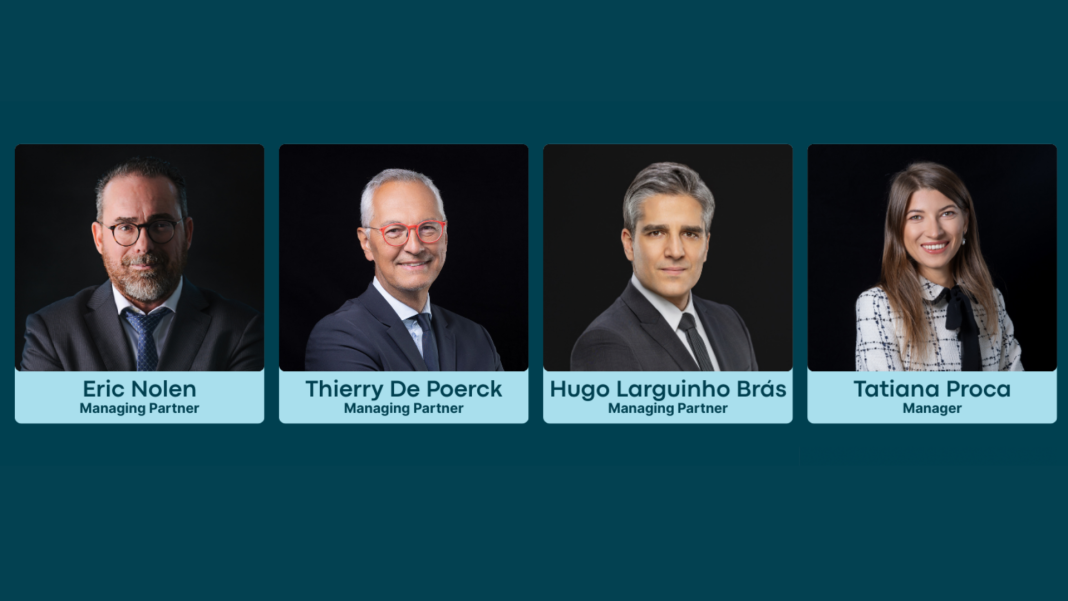

This governance shift reflects a broader trend: sanctions risk is now recognised as a strategic risk, influencing customers, partnerships, investment flows and reputational resilience. As highlighted by Thierry de Poerck during our recent NoW Partners conference, “Compliance isn’t only about rules — it’s about behaviour and readiness.”

Governance under fire: What if your next Audit is a Sanctions Audit?

Company’s Restrictive Measures Exposure Assessment is the backbone of implementing this regulation — without it, everything else is just paperwork. Therefore, sanctions risk cannot be understood through standard AML templates. Institutions must perform a comprehensive, documented risk assessment, considering geography, client profiles, distribution channels, circumvention jurisdictions, outsourced processes and digital assets. The results drive calibration of controls, testing of systems, allocation of resources and training.

In practice, this means three things:

- Governance and ownership – clear responsibility, and traceable decision-making.

- Substance over form – meaningful risk analysis and clear documentation rather than checklists.

- Dynamic review – annual review is a minimum; quarterly is recommended.

Technology as an Enabler, Not an Add-On

Sanctions controls now demand high-performance IT systems, precise data quality and rigorous calibration. Screening tools must apply fuzzy matching, whitelisting, and full historical database scanning when exposure changes. Outsourcing does not reduce accountability — intragroup solutions are treated as external vendors, and failures have consequences even without prohibited transactions.

If the system fails, the responsibility remains.

Building a Culture of Compliance

Circular 25/896 emphasises training and awareness. Online training alone is not enough: gatekeepers and senior leadership need meaningful and interactive education, delivered by experts capable of answering complex questions. Culture cannot be automated.

Combined with clear investigative procedures, incident reporting and escalation rules, culture is the most powerful safeguard against circumvention and reputational damage.

From Regulation to Resilience

Ultimately, this Circular is more than a compliance update. It is a governance philosophy. It pushes institutions to integrate sanctions into enterprise-wide risk management, into Board discussions and into technology investment decisions. It strengthens Europe’s financial credibility and sets out a new standard for responsibility across the financial ecosystem — banks, PSFs, AIFMs, insurers, PSPs, CASPs and outsourced providers alike.

The future of compliance is proportionate, documented, and defensible. The future of governance is connected, informed, and resilient. And as always, the advantage belongs to those who adapt early.

The real question is: are you ready?