This year, financial markets have often seemed like a rollercoaster. Prices have whipsawed as investors have attempted to price heightened geopolitical risk and President Donald Trump’s America first approach to global trade.

In the aftermath of Trump’s “Liberation Day”, the S&P lost 20% only to regain almost all of this in a matter of weeks. At the same time, US Treasury yields were equally volatile, rising and then falling back by nearly 80bps. What can investors do to manage portfolio risk amid such extreme market moves?

One important lesson we think investors can draw from such volatility is the value of maintaining a solid defensive allocation to help smooth portfolio results. We see global investment grade corporate bonds as an effective way investors can achieve this, with the asset class providing three of the key roles investors typically require of fixed income: income, capital preservation and diversification from equities.

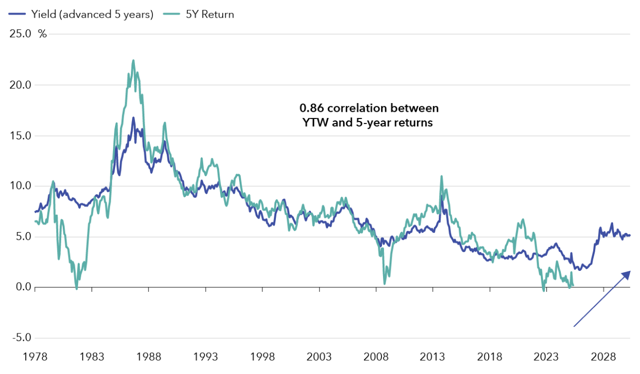

At the end of June, global investment grade corporate bonds provided a yield of around 5.2% (hedged in USD). Historically, yield has been highly correlated to future five-year returns; in other words, at current yields, dollar-based investors could reasonably expect annualised results in the mid-to-high single digits over the next five years.

Yield has historically been a strong indicator of future returns from US corporate bonds

Today’s historically strong fundamentals suggest investment grade corporate bonds are an attractive option to provide defensive ballast and fulfil the role of capital preservation in portfolios. Additionally, with inflation gradually stabilising and central banks cutting rates, duration is once again providing a useful source of diversification.

Spreads are tight relative to historical levels but beneath the surface there are opportunities for bottom-up investors, focused on security selection. Three areas of opportunity include European banks, US electric utilities and pharmaceuticals.

If you are interested in this topic, read the full article here.

To read more investment insights from Capital Group, click here.

To learn more about Capital Group, click here.