Luxembourg’s property market rebounded strongly in the second quarter of 2025, with transaction volumes surging and prices climbing steadily, though temporary fiscal incentives likely played a key role.

A market boosted by fiscal incentives

According to the latest data from national statistics body STATEC, overall housing prices increased 4.5% year-on-year during the second quarter of 2025. This rise is close to the long-term average of 5.0% observed between 2010 and 2025. This resurgence follows a so-called correction period that began in late 2022, when rapidly rising interest rates dampened buyer sentiment across European markets.

The catalyst behind this recovery lies at least partly in fiscal policy interventions. The Luxembourg government extended several temporary tax measures until 30 June 2025, including cutting registration duties by 50% and allowing 6% accelerated depreciation for sales of properties under future completion (VEFA). These incentives usually have a powerful deadline effect, driving buyers to finalise transactions before the measures expired definitively.

Existing properties dominate market activity

The main development concerns the existing property segment. Existing apartments sales hit 1,575 units in the second quarter of 2025, the highest figure ever recorded since STATEC’s data collection began in 2007. That’s up 72.9% from the same period in 2024, and significantly exceeds the pre-crisis average of 1,035 transactions observed between 2017 and 2021.

Existing houses experienced even more growth, with transactions almost doubling year-on-year to 1,104 sales. Price appreciation proved robust across existing properties. Houses led the market with 7.1% annual growth, while apartments rose 3.2%. Houses likely outperformed due to limited supply and continued demand from affluent buyers seeking space and privacy.

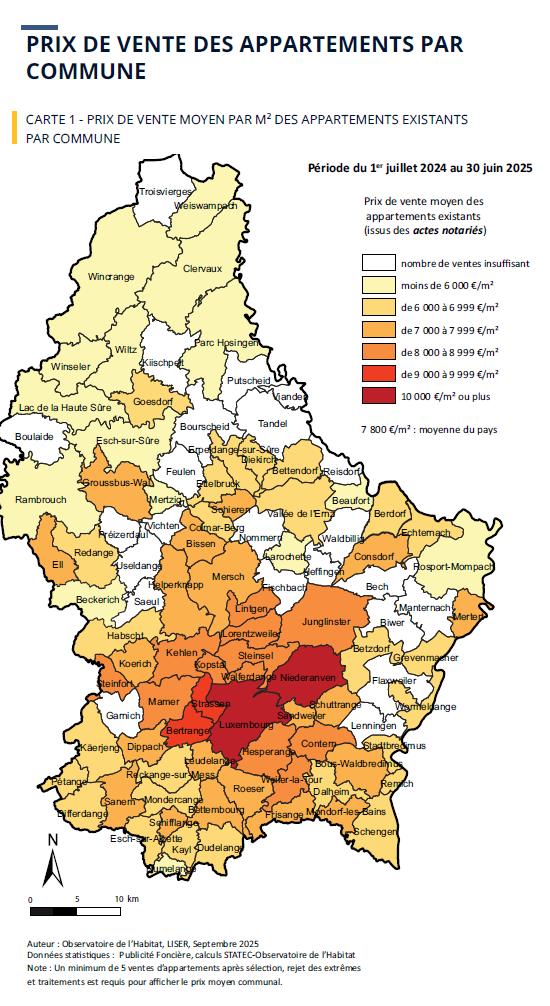

Données statistiques: Publicité Foncière, calculs STATEC-Observatoire de l’Habitat

Note: Un minimum de 5 ventes d’appartements après sélection, rejet des extrêmes et traitements est requis pour afficher le prix moyen communal.

Luxembourg existing apartment sale prices by commune map

The map shows the average sale prices per square metre for existing apartments by

commune for the period from July 1, 2024 to June 30, 2025.

○ White: Insufficient number of sales

○ Light yellow: Less than 6,000 €/m²

○ Yellow: 6,000 to 6,999 €/m²

○ Light orange: 7,000 to 7,999 €/m²

○ Orange: 8,000 to 8,999 €/m²

○ Red-orange: 9,000 to 9,999 €/m²

○ Dark red: 10,000 €/m² or more

The country average shown is 7,800 €/m². The map highlights stark north–south divides,

with Luxembourg City, Niederanven, and nearby communes commanding the highest prices, and northern areas remaining far more affordable.

Source: STATEC

New construction segment lags behind expectations

New construction tells a more complex story. Sales of apartments under future completion (VEFA) increased 126.0% year-on-year. Still transactions totalled just 348 units, roughly half the pre-crisis average of 694 sales recorded between 2017 and 2021. New apartments commanded an average of €10,028 per square metre, a substantial 28.6% premium over existing properties at €7,800 per square metre.

Regional price disparities remain pronounced

Location remains the key driver of property values nationwide.

The Canton of Luxembourg maintains its position at the market apex, with existing apartments averaging €9,764 per square metre. This represents a 61.1% premium compared to northern regions, where prices average €6,062 per square metre.

For houses, the geographic premium is even more pronounced. Properties in the Luxembourg Canton average €1,294,206, more than 67% above the northern average of €772,787. These wide gaps reflect multiple factors, including commuting times, infrastructure quality, school access, and perceived social status considerations that influence buyer preferences.

Travel time to Luxembourg City

Recent research highlighted in the STATEC report demonstrates that travel time to Luxembourg City explains price variations more effectively than simple distance measurements. Properties offering convenient access to the capital command substantial premiums, even when located outside traditional prime neighbourhoods. In fact, the relationship between distance and travel time can show significant variability:

Luxembourg’s property market is as much about location as it is about connection.

Luxembourg’s property market is as much about location as it is about connection. In Limpertsberg, one of the capital’s most desirable central districts, residents enjoy an average travel time of just 9.7 minutes to the city centre, a convenience reflected in some of the country’s highest real estate prices. By contrast, Kockelscheuer, situated around 10 kilometres away, sees commutes stretch to 27 minutes amid regular congestion, softening its appeal despite its proximity. Thanks to efficient road infrastructure, Mersch maintains a respectable 29.8-minute journey, balancing accessibility with relative affordability.

Meanwhile, Esch-Belval, the thriving southern urban hub roughly 20 kilometres from Luxembourg City, faces 39.1-minute commutes during peak hours, an inconvenience that its growing ecosystem of business, culture, and innovation increasingly offsets.

The influence of fiscal policy on market cycles

The second-quarter surge underscores how fiscal policy continues to shape Luxembourg’s housing cycles. Similar patterns emerged in 2014, when impending VAT increases triggered a rush of off-plan purchases, and again in 2017-2018, when temporary reductions in capital gains taxation stimulated significant market activity. While these measures successfully boost short-term transaction volumes, they inevitably create market distortions that investors must navigate carefully. Buyers accelerate purchases to capture fiscal benefits, generating artificial peaks.

More concerning is the limited impact on new construction supply despite targeted interventions. After 18 months of developer and investor incentives, sales of apartments under future completion (VEFA) remained well below historical norms. This could suggest deeper structural issues beyond fiscal policy, including land scarcity, planning process constraints, and construction industry capacity limitations.

Future market outlook and strategic implications

STATEC’s data depicts a market in transition. Transaction volumes could decline towards the end of 2025, following the expiration of tax benefits. For investors and developers, the challenge is distinguishing genuine demand from incentive-fuelled momentum. The strong performance of existing properties could suggest genuine market strength, particularly amongst affluent buyers less sensitive to fiscal incentives.

Mortgage affordability remains critical to market accessibility for average households. Recent analysis by RTL Luxembourg indicates buyers require minimum net monthly income exceeding €5,000 to finance a €450,000 property purchase. This threshold effectively excludes many households, particularly younger professionals and growing families, directing them toward rental accommodation. Recent data shows homeownership rates declined from 67.6% in 2023 to 63.5% by end-2024.

Policy makers now face tough choices. Temporary incentives provide short-term relief and political visibility but fail to address fundamental supply constraints that perpetuate

affordability challenges. The government recently announced measures to accelerate construction permits, requiring municipal decisions within four months, alongside reforms to increase affordable housing requirements in new developments.

This article was published in the 7th edition of Forbes Luxembourg.

Read more articles: