Luxembourg is fast becoming Europe’s green fintech hub, thanks to bold public-private efforts, data innovation, and purpose-driven programmes.

Luxembourg’s emergence as a European hub for green fintech is no accident. Purpose-built programmes, public-private coordination, and pressure to deliver real sustainability outcomes are creating an environment where mission-driven fintech startups thrive. At the heart of this development are the Luxembourg House of Financial Technology (LHoFT) and the Luxembourg Sustainable Finance Initiative (LSFI).

LHoFT’s green boom

For LHoFT CEO Nasir Zubairi Luxembourg’s strength lies in its compact, highly networked financial ecosystem.“We offer a unique intersection of finance, technology, innovation, and policy. Luxembourg is a global leader in sustainable finance,” said Zubairi. LHoFT’s annual flagship support programme, Catapult, helps early-stage companies scale their ESG impact.

“The programme is a week-long bootcamp focused on connectivity, impact, and growth”

“We support 10 early-stage companies in the green fintech space. The programme is a week-long bootcamp focused on connectivity, impact, and growth. Post programme, we continue to provide support to the firms, particularly in connection with scaling their business and building opportunities in Luxembourg,” said Zubairi.

The programme is selective, with ambitions beyond funding. The first indicator of success is “selection.” “If the selection committee agree that the 10 firms are doing good in the realms of green fintech, by definition, by helping them scale — ie, increase in terms of people, revenues, and customers, we are having a positive impact,” said Zubairi.

Inaugural success

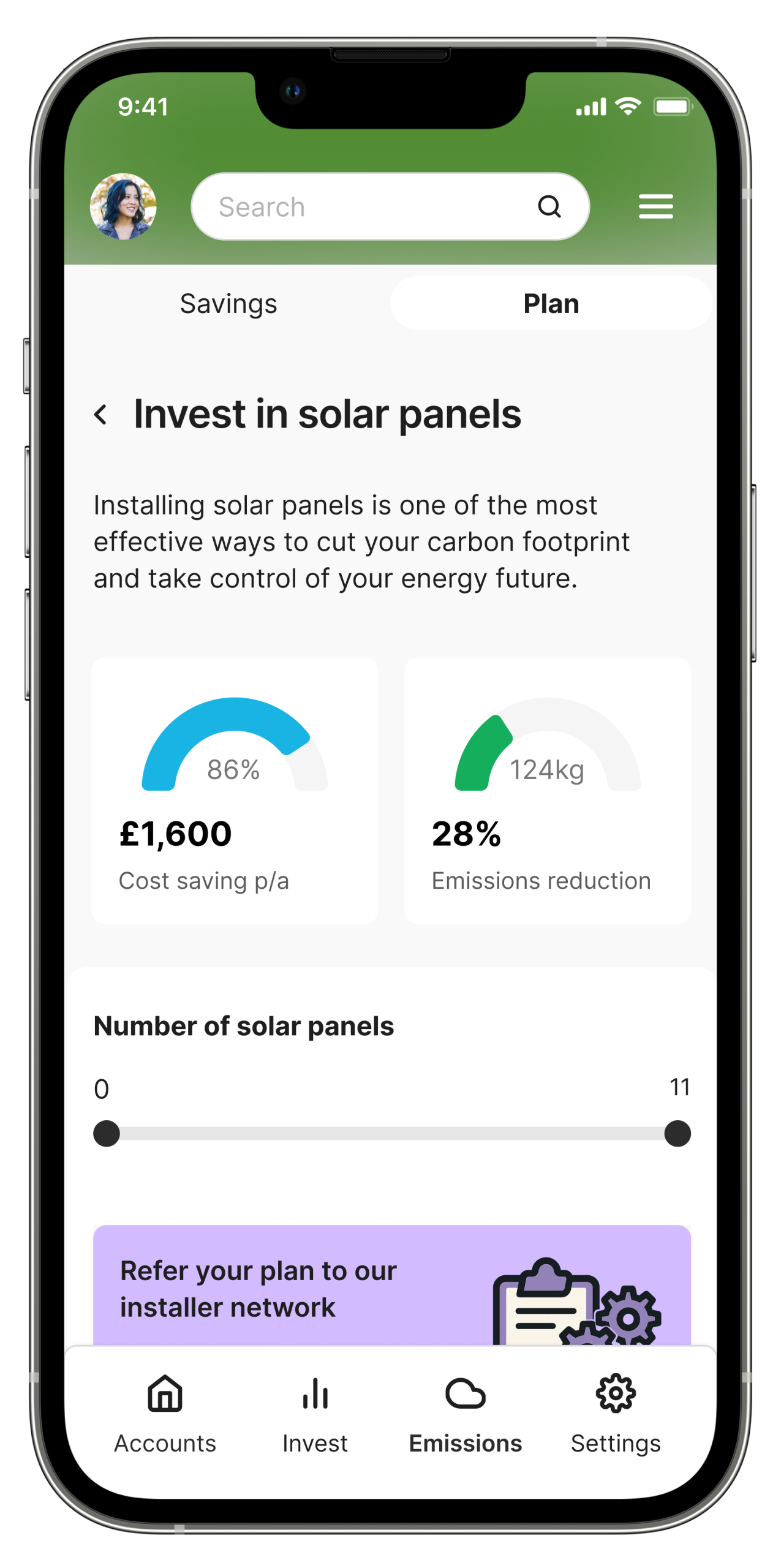

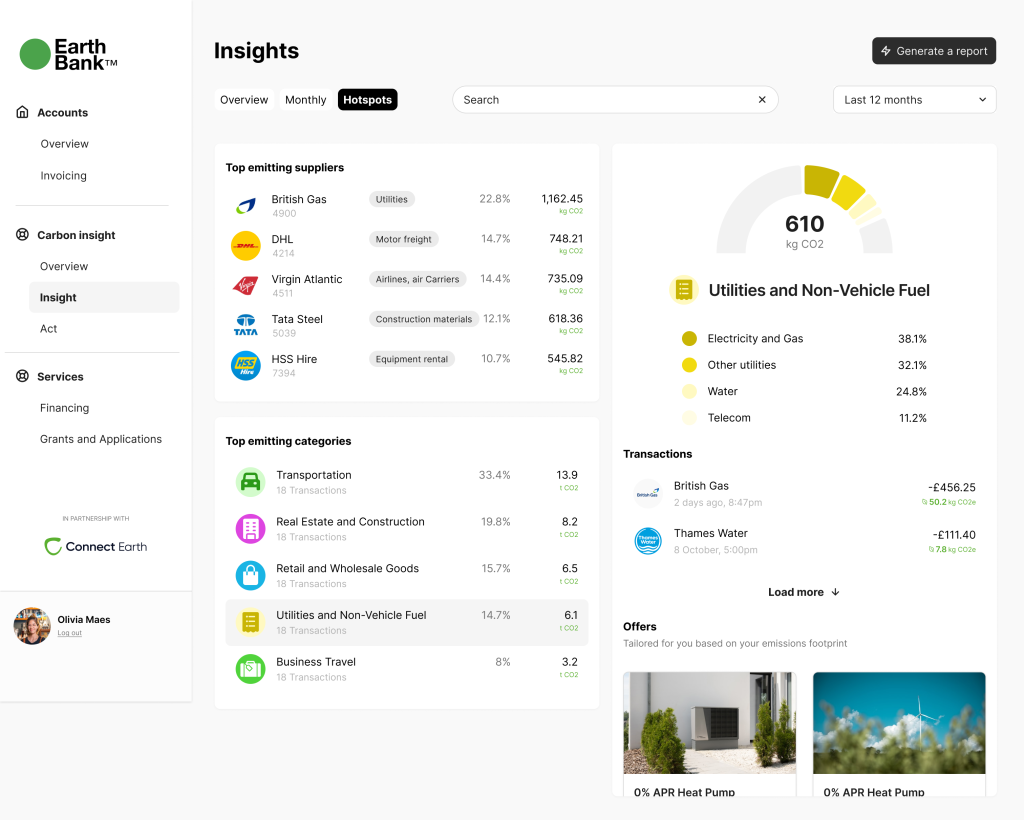

Connect Earth and Carbify prove the formula works. Connect Earth helps banks and financial institutions integrate carbon footprint tracking into their apps using AI-powered infrastructure. Their technology solves the challenge of scaling carbon emissions measurement by simplifying complex data and models. By embedding their API into digital finance platforms, they promote financial inclusion through accessible climate impact insights for all users.

Carbify invests in eco-friendly, biodiversity-focused projects, like tree planting, to promote true environmental sustainability. It works with ecologists to guide decisions, prioritising the planet over politics or profit. Through public education and social initiatives, Carbify empowers people to take meaningful action for the Earth’s future.

Yet LHoFT is thinking beyond growth, into actual long-term environmental impact. “We are working with the Ministry of Finance and LSFI to develop methodologies to be able to measure the specific sustainability impact of the businesses over the years post the programme,” said Zubairi.

LHoFT’s ambitions also extend into data standardisation. The organisation is collaborating with the University of Luxembourg’s Interdisciplinary Centre for Security, Reliability and Trust (SnT) and the LSFI on an AI-driven data project. “The ambition is to create a means to collect and structure that data, and then look at quantifying sustainability impact on financials, e.g. what is the net benefit on Weighted Average Cost of Capital (WACC) by going green?” said Zubairi.

Coordination, upskilling and progress tracking

LSFI CEO Nicoletta Centofanti says Luxembourg’s progress is rooted in collaboration. “We are the coordinating entity on sustainable finance. We are here to support the financial sector, accelerating their transition to sustainability, building expertise, and helping mobilise capital. And we are also here to track and measure the progress of that transition,” said Centofanti. LSFI’s mandate as a public-private partnership covers expertise and leadership building, unlocking potential and mobilising the financial sector, and measuring and communicating progress, the three pillars of LSFI’s 2030 strategy.

LSFI’s main added value —accessibility, coordination, and public-private commitment supports this mission. “Accessibility in the sense that we are Luxembourg’s gateway to sustainable finance. It is our mission to drive change across the whole ecosystem as a Centre of Excellence and Knowledge Hub. Coordination, as we facilitate connections among different stakeholders, locally and internationally. And then commitment: our foundation lies indeed in a strong public and private commitment,” said Centofanti.

Among the many LSFI projects, one has helped build up and organise resources to upskill the sector and improve data accessibility. “We are trying to bring theory and practice together. Last year, we had more than 350 participants during our flagship event, the LSFI Summit,” said Centofanti.

On biodiversity, the LSFI has run two masterclasses and is aware that its efforts are key to bring fintech into the game. “We have built a platform, we’ve mapped more than 100 tools that provide data across the different ESG themes. And in particular, we have 19 on biodiversity,” said Centofanti.

To help financial actors better choose and use ESG data providers, LSFI developed a practical questionnaire. This hands-on orientation is also reflected in their support of LHoFT’s AI-data driven project. “The LSFI is providing support and guidance to this collaboration. It’s a three-year project and we believe it is very promising,” said Centofanti.

Shared vision, complementary roles

Both organisations acknowledge that the green fintech boom requires bottom-up innovation and top-down infrastructure. While LHoFT focuses on accelerating purpose-driven startups, building momentum for firms like Connect Earth, LSFI ensures the ecosystem those firms grow into is structured, informed, and forward-looking, especially in complex areas like ESG data, biodiversity metrics, and stakeholder coordination.

Both organisations are aligned in mission and method. “It’s fundamental that the LSFI is involved in projects, to make sure that the outputs are really relevant for the industry,” said Centofanti. LHoFT’s bootcamps, alumni support, and AI experiments are creating the conditions for startups to deliver measurable ESG value. LSFI is making sure those startups grow in fertile ground, where data is usable and helps to respond to regulatory requirements, and the whole ecosystem pulls in the same direction.

Read more articles:

Why Chinese Banks Keep Choosing Luxembourg As Their EU Gateway

Luxembourg’s Tax System Goes Digital: From Paper Trails To Pre-Filled Returns