High yield can bring several benefits to portfolios: a lower volatility alternative to equities, attractive yield per unit of duration and a complement to higher duration assets that can help reduce rates volatility.

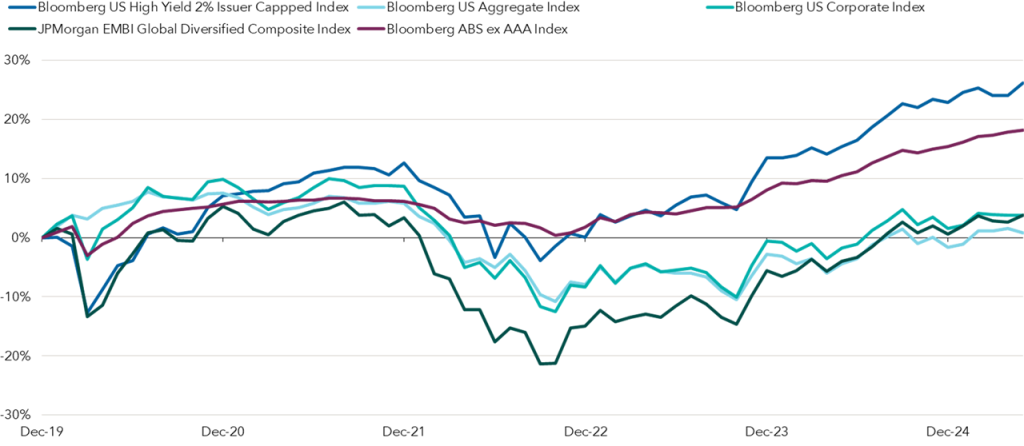

Financial markets have navigated an exceptionally turbulent period over the past five years. Severe shocks have included the global pandemic in 2020, aggressive rate hikes by central banks in 2022 and the imposition of tariffs in 2025. Despite these significant disruptions, the high-yield (HY) market has demonstrated remarkable resilience, emerging as the best-performing fixed income sector by a substantial margin.

High yield has outpaced most fixed income sectors since 2020

There are reasons to believe structural changes in the high yield market have made it more resilient to shocks and it appears well positioned to continue to deliver strong results in the future. These strengths also partially explain why spreads have been trading at relatively tight levels compared to long-term historic averages and can continue to do so absent an external shock.

Since the global financial crisis (GFC), companies have been more disciplined in how they use debt. Consequently, the quality of companies within high yield (HY) indices has improved. Today, more than 50% of the index is rated BB, the highest credit quality segment within high yield.

The maturity profile is also manageable. A substantial portion of the maturities for 2025 and 2026 have already been addressed, with less than 5% of the HY market expected to require refinancing by end of year.

Since ‘Liberation Day’ in early April 2025, dispersion within the high yield market has surged to levels we have not seen in the past five years. This is creating multiple opportunities for active managers to capture value.

If you are interested in this topic, read the full article here.

To read more investment insights from Capital Group, click here.

To learn more about Capital Group, click here.