Amid global uncertainty, Luxembourg’s Management Companies – or ManCos – are quietly evolving into some of the most agile and sophisticated players in Europe’s asset management ecosystem.

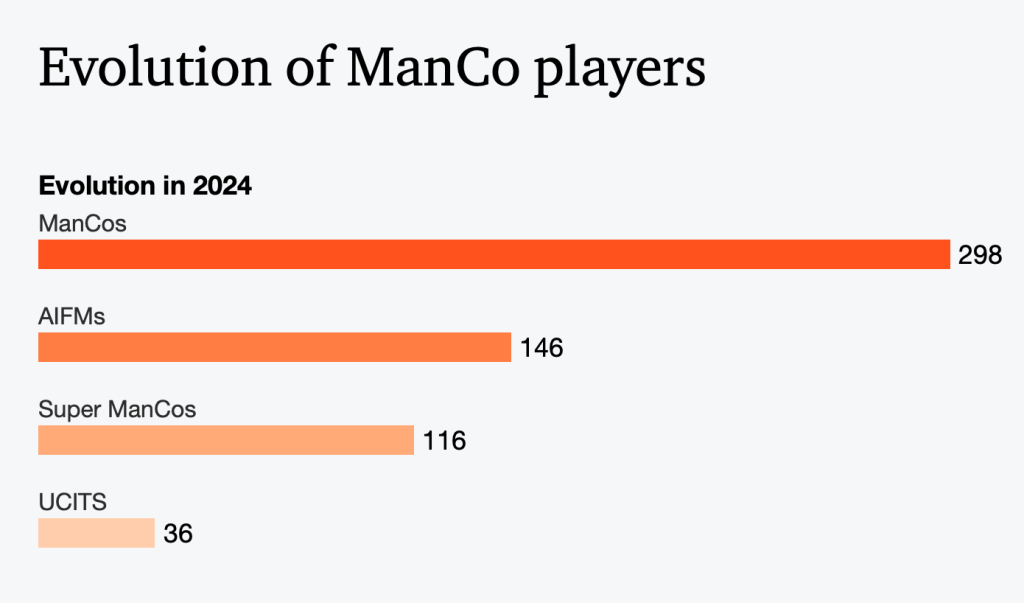

According to PwC Luxembourg’s newly released 2025 Barometer, which captures insights from 71 firms representing 82% of total ManCo assets under management (AuM), the transformation of the sector is no longer about scale. It’s about strategy, specialisation, and smart use of technology.

A Market in Motion

Luxembourg’s ManCo market is now overseeing €5.858 trillion in AuM – a 12.3% increase year-on-year – with growth coming from both traditional and alternative assets. This reflects the Grand Duchy’s standing as a preferred home for UCITS and AIFs, hosting nearly a third of Europe’s regulated fund assets.

But the real story lies behind the numbers. “ManCos are being reshaped,” says Laurent Butticè, Management Company Leader and Audit Partner at PwC Luxembourg. “This strategic shift reflects a trend towards insourcing core functions to optimise the value propositions, while outsourcing operational functions both within the group and through third-party providers to benefit regulatory expertise and operational efficiencies”.

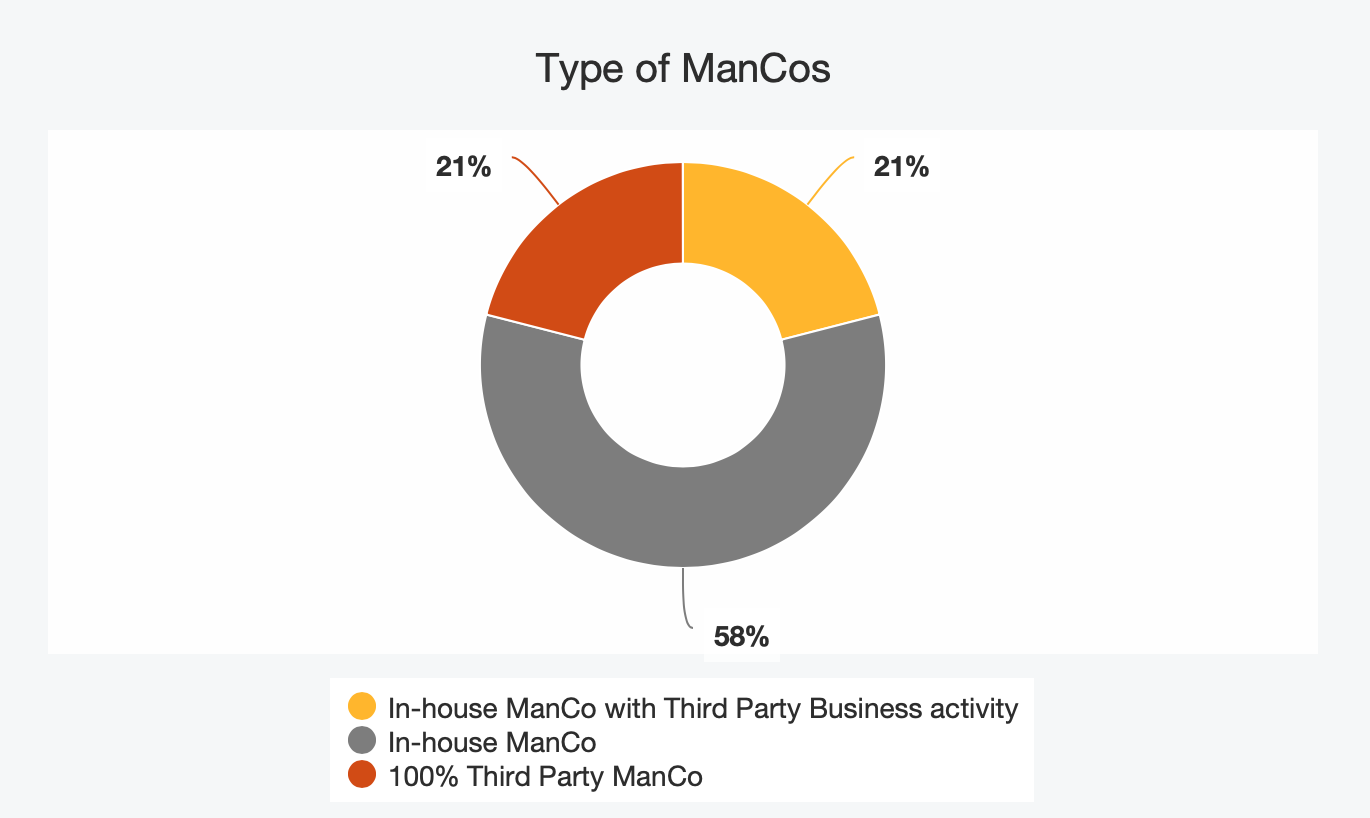

This is especially true for third-party ManCos, which now handle 19% of Luxembourg’s total AuM. Far from being just external service hubs, these firms have evolved into strategic partners, helping fund managers navigate compliance, distribution, and fund structuring – all under one roof.

Tech and Talent Take Centre Stage

If there’s one thing ManCos agree on, it’s the power of technology. Nearly 90% of respondents said digitalisation is essential to improving margins. Many are betting on AI and real-time risk analytics to sharpen their decision-making and trim costs.

And it’s not just about tech. Luxembourg’s ManCos are hiring more Conducting Officers and Non-Executive Directors, a sign of rising governance expectations. A quarter of Conducting Officers now oversee tax matters – a function increasingly seen as strategic, not just operational.

Going Global – But Keeping It Local

While the Luxembourg brand remains strong, ManCos are expanding their presence abroad. The report noted that more firms are opening branches across Europe to support fund distribution and marketing, ensuring closer alignment with investors and regulators in key markets. At the same time, acquisitions have supported growth.

In April 2024, Gen II, a New York-based private capital fund administrator, acquired Crestbridge, a European ManCo. This acquisition expanded Gen II’s presence in Luxembourg, increasing its assets under administration to over USD 1 trillion. Meanwhile, in May 2024, Vistra obtained regulatory approval to acquire Kroll (Luxembourg) Management Company and bring it into Vistra Luxembourg family of companies. A further merger with Vistra Fund Management followed at the end of 2024.

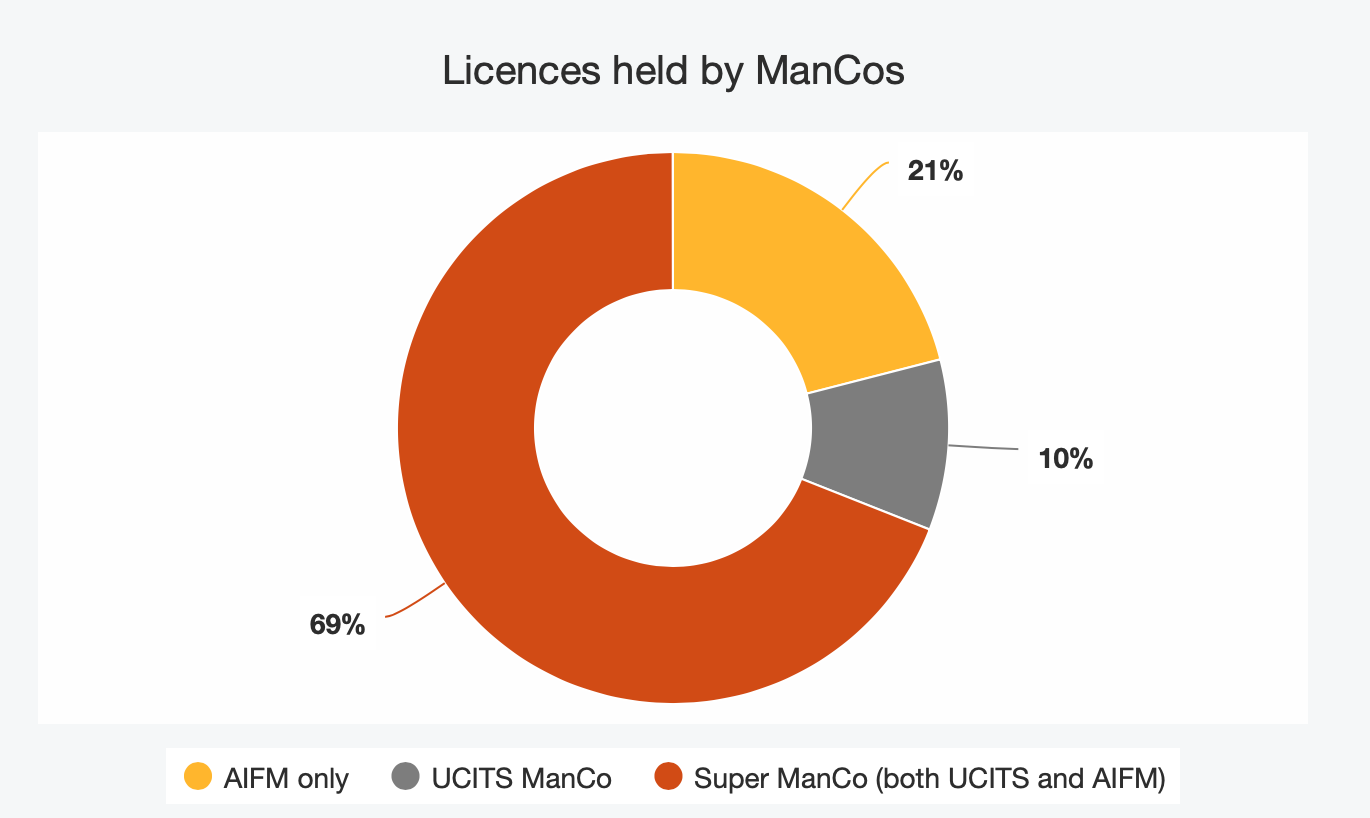

PwC’s report paints a picture of an industry quietly but confidently maturing. ManCos are no longer just vehicles to meet regulatory requirements – they’re becoming full-fledged strategic platforms. The rise of Super ManCos (those licensed for both UCITS and AIFs) is a natural extension of this trend.

Find all the original data on the official website of PwC Luxembourg.

Read more articles:

Is Luxembourg Still Europe’s Wealth Capital?

Globalisation Isn’t Dead. It’s Changing.

AI And The Grand Duchy: A Strategic Pivot Toward Digital Leadership