As satellite deployment accelerates and Europe seeks independence in space technology, Luxembourg’s EmTroniX and French antenna maker Anywaves have merged, to offer end-to-end satellite systems, reducing supply chain complexity and accelerating time-to-orbit.

The global space technology market is booming, with the commercial sector driving roughly 78% of growth, according to a 2024 WEF/McKinsey report. Satellite deployment timelines are shrinking, pushing companies to accelerate development, compress lead times, and scale industrial capacity.

For Luxembourg space RF electronics firm EmTroniX, a merger with French RF firm Anywaves was the surest way to thrive in this environment. “I don’t believe it can fail. It can only bring the two companies further than what we were before,” says EmTroniX CEO and founder Cédric Lorant.

Lorant established the firm in 2001 after working in engineering at Delco Electronics in Luxembourg. Based out of the Zone Industrielle Bommelscheuer in Hautcharage, the electronics company pivoted into space applications, long before Luxembourg’s 2016 Space Resources initiative. Among other projects, in 2014 it had a payload on the Manfred Memorial Moon Mission (4M), the first private mission around the moon. It developed its first product following involvement with the interplanetary defence mission, providing a low frequency radar for HERA, an interplanetary defence mission to map the Dimorphos asteroid.

Anywaves was founded by Nicolas Capet, who completed a PhD at ONERA, before joining the French space agency, CNES. Convinced that new space would disrupt the sector and determined that Europe should be part of that disruption, Capet established Anywaves in 2017. The two began collaborating in 2019.

Product Lines

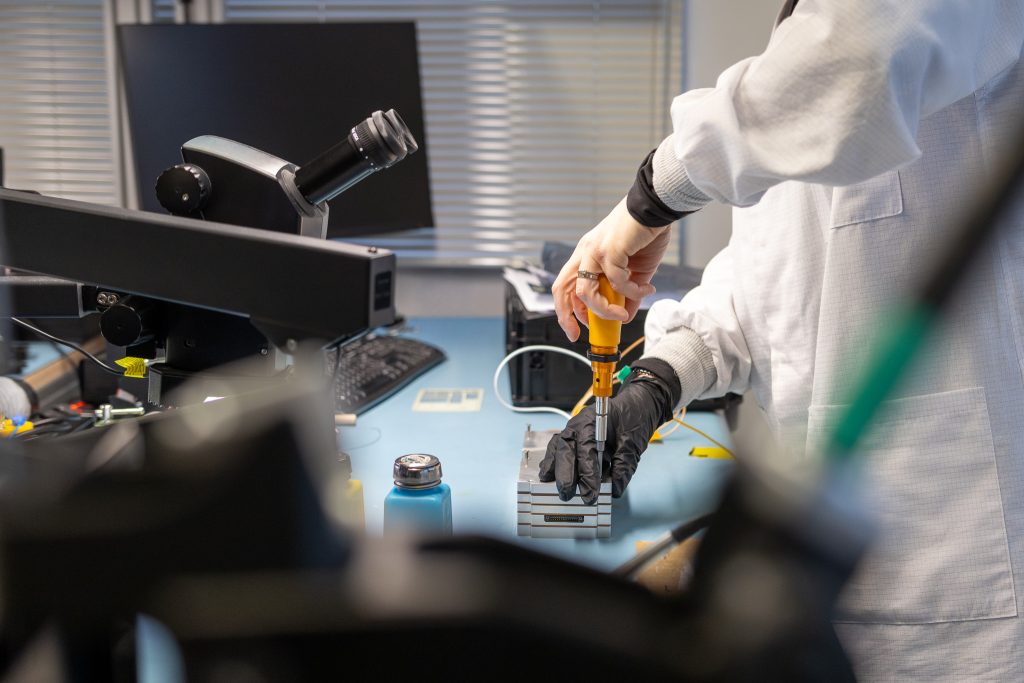

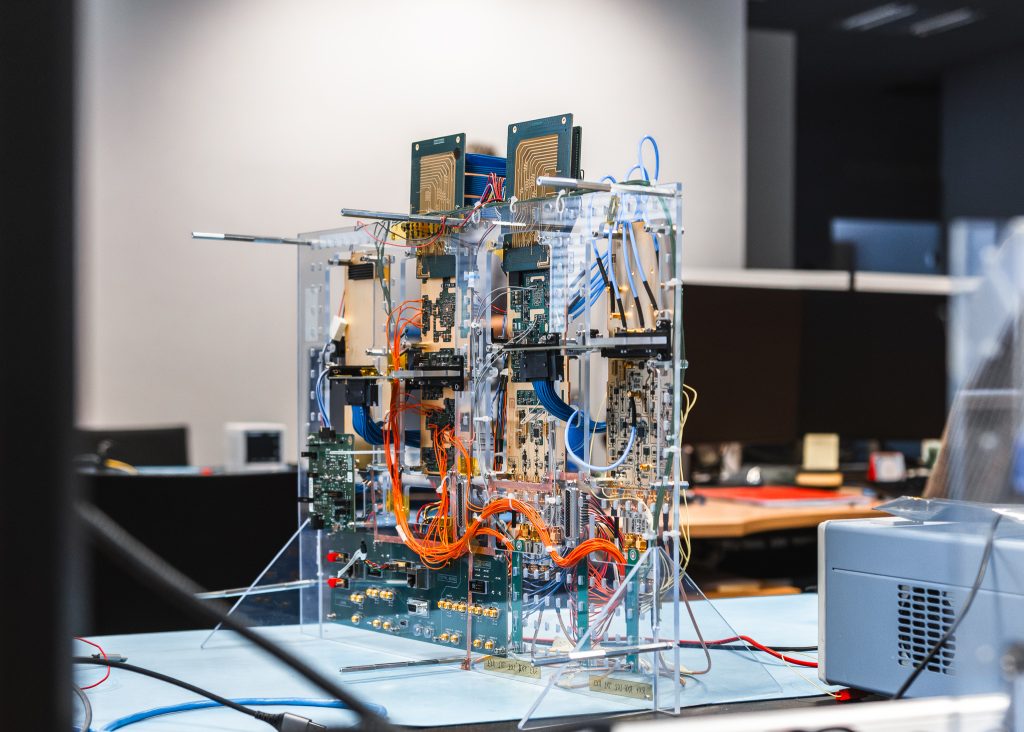

Today EmTroniX develops advanced space electronics, FPGA systems, software‑defined radios (SDRs), radio frequency and avionics providing flexible, high-performance computing, communication, and control for satellites. Anywaves focuses on the antenna design and radio frequency systems. Combined, they can offer fully integrated solutions, easing interoperability, reducing supply chain complexity, and speeding time-to-orbit.

“Currently, space competition is extremely intense,” says Capet, adding: “We need to accelerate the development time and to put assets into orbit, so the speed is of major concern, and in space, you cannot sacrifice the quality, the reliability of the equipment and antennas.”

A Geopolitically Strategic Merger

It is no secret that the US dominates the space sector, in terms of public and private investment, and number of satellites in space. Capet and Lorant believe Europe can compete by leveraging its engineering strengths, and both companies manufacture their products in-house, keeping skills local.

“That’s also extremely important,” says Lorant, adding that the team in Luxembourg will grow by up to 30 FTEs in the next two years. To accommodate its growing team, EmTroniX will expand its Hautcharage facility by 1,230 square metres, bringing total industrial space to 2,410 square metres and supporting an anticipated 30 new hires over the next two years.

Reliability & Diplomacy

Consolidations like this, which create fully European entities, could strengthen Europe’s competitiveness in new space. “It brings confidence to our customers outside Europe, knowing that it’s managed in Europe without dependencies,” adds Capet. Luxembourg’s space diversification strategy and proactive space agency will also play a role. The merged entity will be seeking support to boost industrial capabilities from the LSA and other institutions in the coming months.

But challenges remain. Europe still depends on the US for some electronic components, notably chipsets. The European Commission is investing heavily to reduce this reliance, but full autonomy is expected to take more than five years, Capet says.

For the short-term future, the merged firms will focus on doing what they do best and scaling. This involves a 40% increase in headcount, adding engineers, technicians but also business developers. The merged group plans to invest multiple millions in industrial capabilities over the next three years. While funding sources are still being finalised, Capet says, “All options are open,” hinting that European investment will likely play a key role.

Read more articles:

OCSiAl Stakes Its Future On Luxembourg As Scale Up Accelerates

Luxembourg Sets Its Sights On The Moon Again

Luxembourg’s Digital Gatekeeper: INCERT CEO On Cryptography, ESG, And Energy Risks