€2 million might buy a villa in Tuscany or even a château in France. In Luxembourg, it buys you an apartment in Limpertsberg and, apparently, the right to feel wealthy.

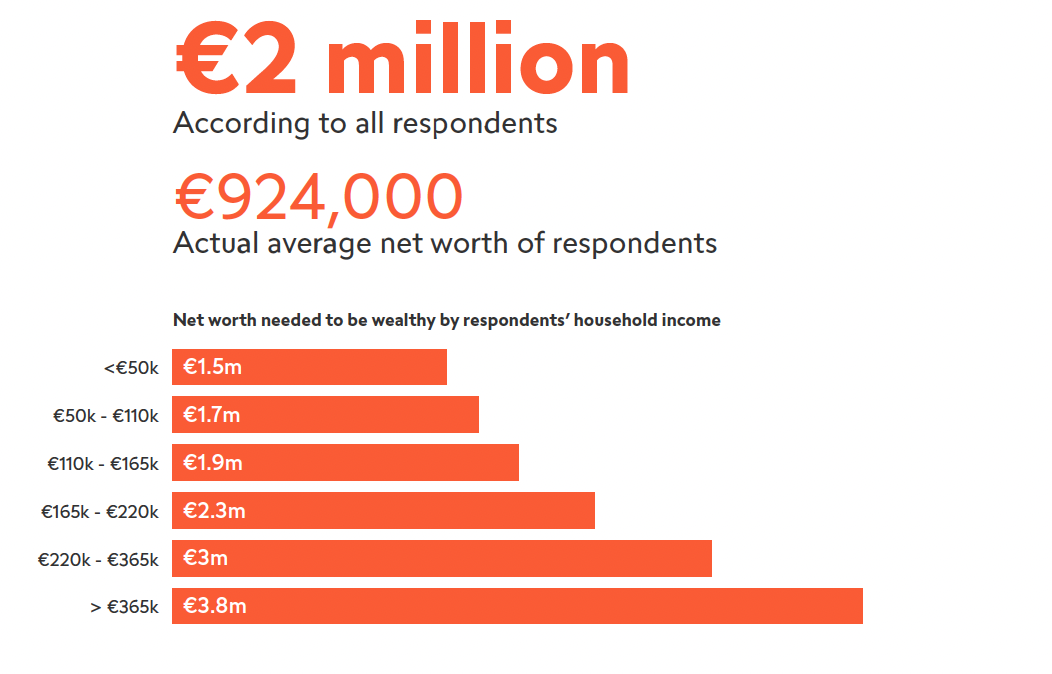

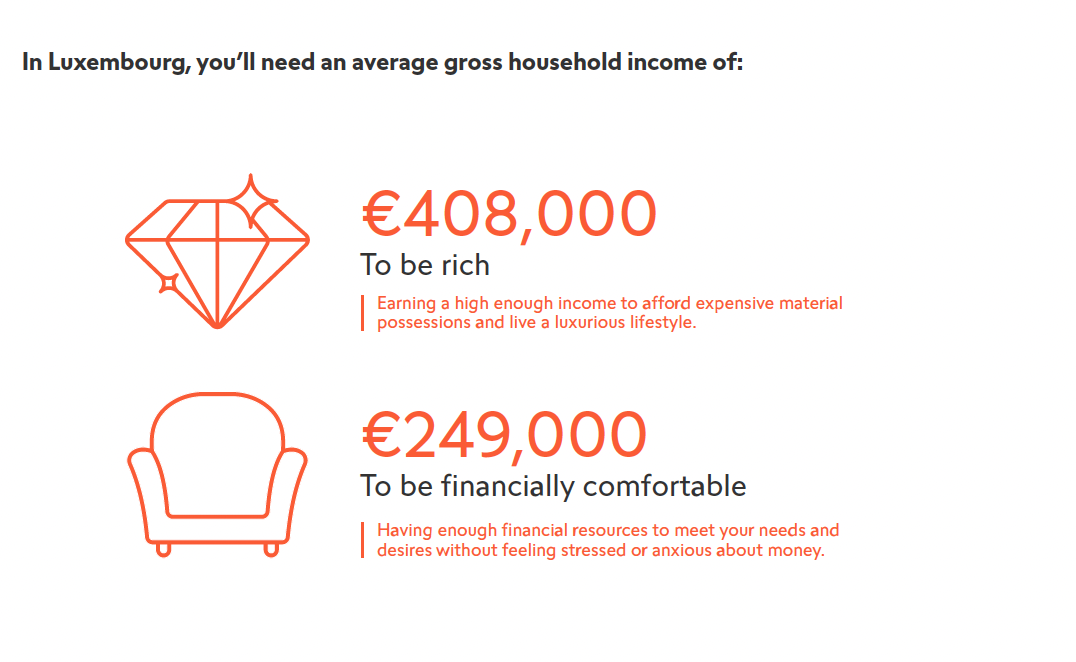

Swissquote Bank took the pulse of Luxembourg’s evolving wealth psyche, surveying residents on what it means to be rich in one of Europe’s most expensive markets. The verdict: you’ll need roughly €2 million in assets to start feeling wealthy.

Among Swissquote customers, the survey found that the threshold was even higher, at €2.5m, while client residents placed it at €1.7m.

Perceptions of wealth diverged sharply across generations. Gen Z residents (aged 18 to 28) said that €1.2m would be enough to qualify as wealthy. Meanwhile, the threshold for being considered wealthy rose for respondents with higher earnings. For instance, those earning €365,000 a year estimated they’d need €3.8 million to feel wealthy, compared with €3 million among those earning €220,000.

What is clear is that few Luxembourg respondents have reached the wealthy threshold. The average estimated net worth of respondents was €924,000. Swissquote customers had holdings of nearly €1.4m, while non-customer residents had assets of €568,000.

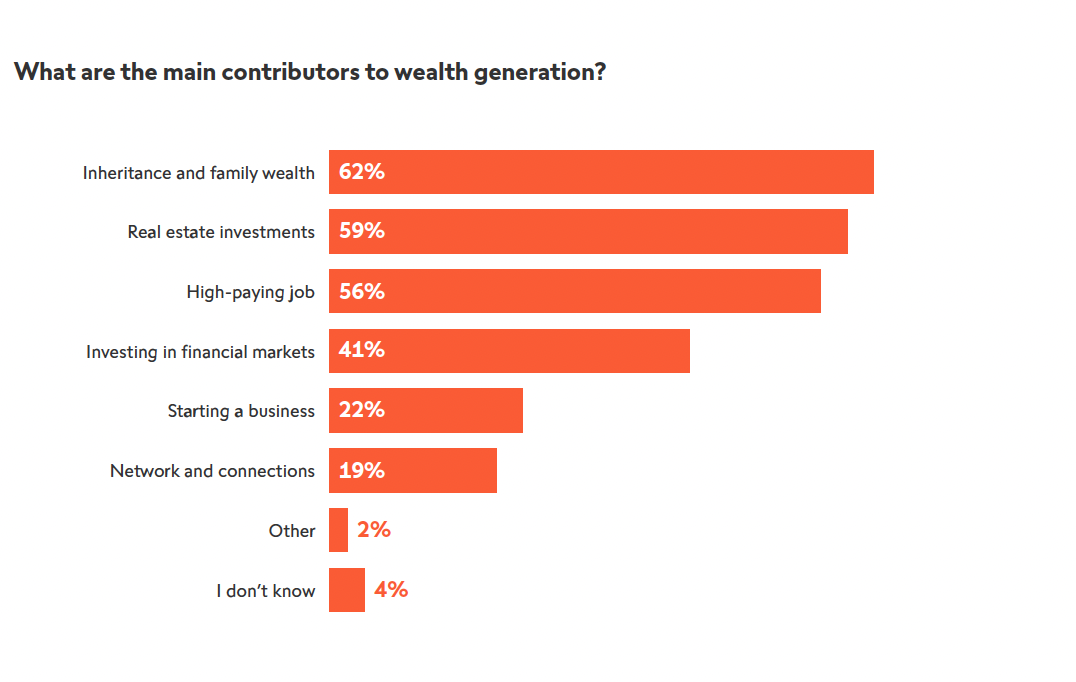

When asked how they expect to build wealth, most respondents cited inheritance (62%) and property (59%) as their top options, ahead of high-paying jobs (56%) and financial investments (41%). Fewer than one in four believed entrepreneurship was the surest path, a telling insight for a country often seen as Europe’s financial engine.

Luxembourg’s Quiet Anxiety About Retirement

Yet threats to personal wealth remain. In 2025, geopolitics overtook inflation as Luxembourg’s top financial worry, reflecting broader European unease.

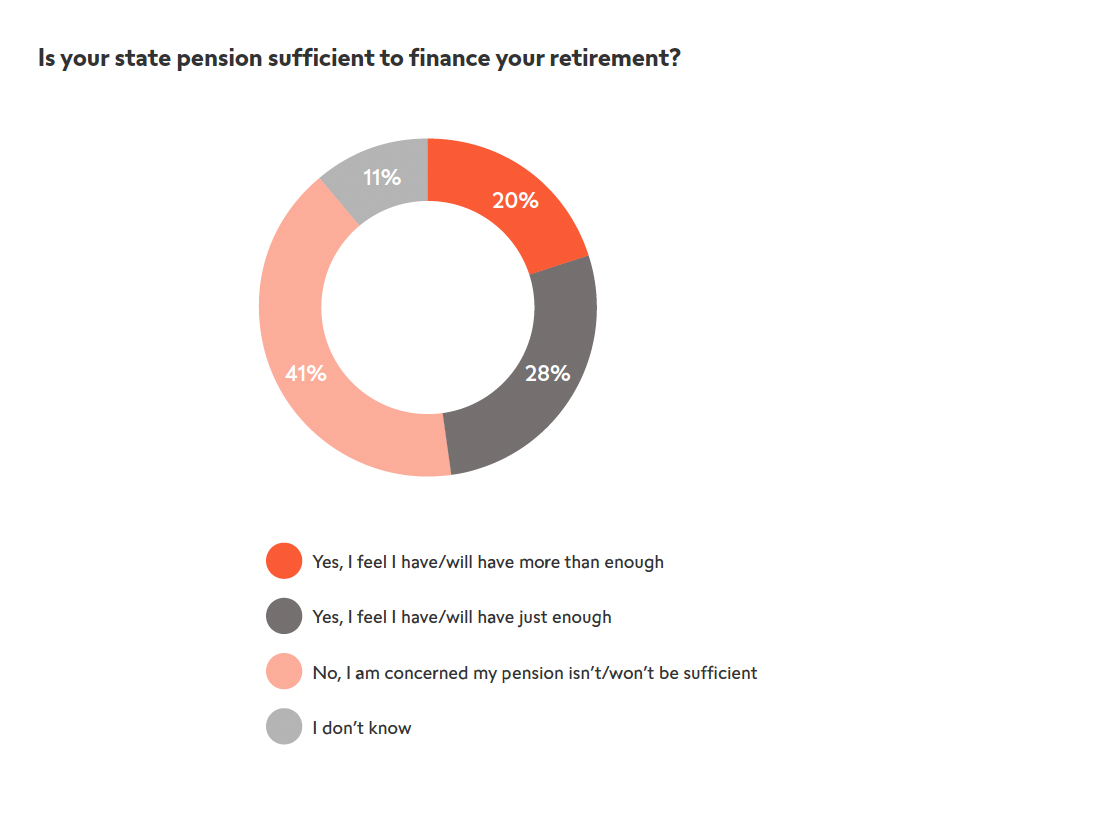

Meanwhile confidence in Luxembourg’s pension system was low, with four out of ten respondents believing their monthly payments won’t be sufficient for when they retire. Concern was highest among Gen Y and Gen X respondents.

Even 43% of those with incomes of more than €365,000 doubted the adequacy of state pensions. Men are more likely than women to expect their pensions to be just enough or more than enough for their retirement. Perhaps unsurprisingly, confidence in the pension schemes was highest among respondents aged 61 and above.

Filling the pension gap

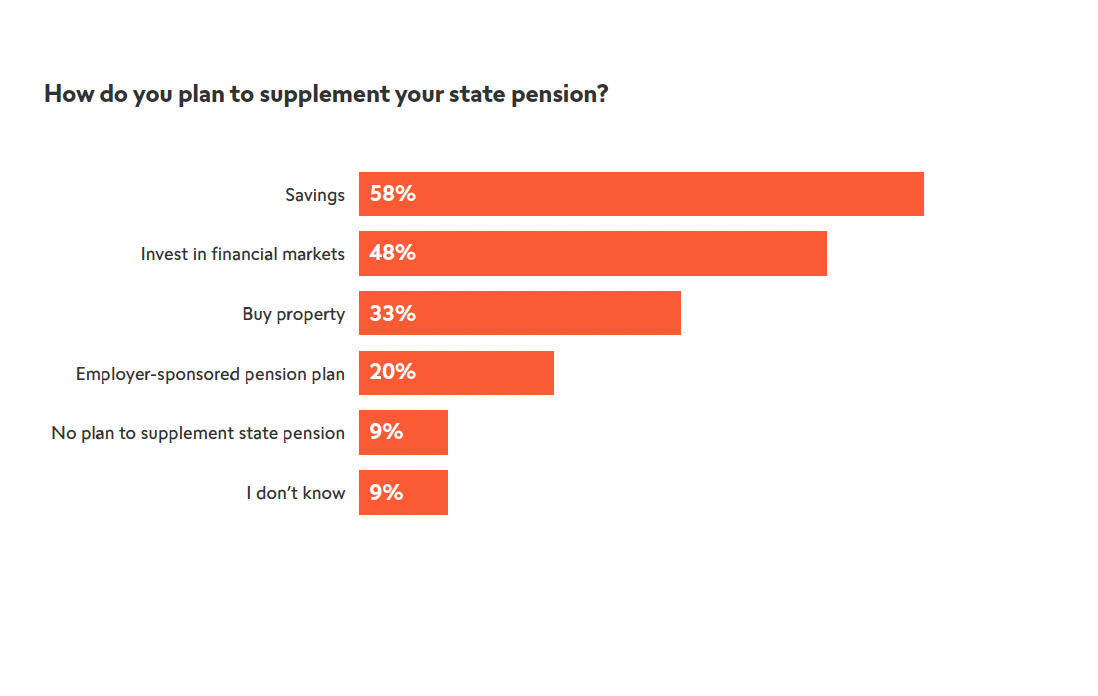

Savings were cited as the most-common way of topping up pension schemes (58% of respondents). Eight in ten Swissquote clients said they invest in financial markets to offset future expenses, while a third still view property as the best retirement hedge. Nearly one in ten admitted having no plan at all.

The Gen Z age cohort (ages 18 to 28) were more likely to favour property investments, over stocks and bonds to boost pension income. Respondents aged 29 to 60 were more likely to depend on a combination of savings, successful financial investments, and employer-sponsored pension schemes.

Beyond money, Luxembourg residents increasingly define wealth in lifestyle terms. Half equate it with having more time, and nearly two-thirds with the freedom to work where and how they want, though that sentiment is waning compared to 2024.

Three-quarters of respondents surveyed said they would rather have a healthy work-life balance as opposed to a successful career, a statement that was repeated across age and income brackets.

This shift marks a broader redefinition of wealth, said Jeremy Lauret, Chief Commercial Officer at Swissquote Bank Europe. “While many still associate wealth with freedom and financial security, we see a growing focus on personal responsibility, especially as Luxembourg debates pension reform and younger residents seek to diversify their income sources.”

Read more articles:

Luxembourg’s Banks Take The Lead In Europe’s New Era Of Secure Payments