In the fast-evolving world of investment, few places have captured the global spotlight quite like Luxembourg. Over the past five years, this small but mighty Grand Duchy has transformed into a powerhouse for alternative asset management, with assets under management (AuM) soaring to an astonishing €2.4 trillion.

As investors grapple with a landscape marked by geopolitical uncertainty and shifting monetary policies, Luxembourg’s unique blend of regulatory clarity, operational expertise, and strategic location has made it the go-to hub for alternative funds worldwide. But what exactly lies behind this meteoric rise, and why are so many roads in the alternative asset world leading here?

The recently published 2024 AIFM Reporting Dashboard by the Commission de Surveillance du Secteur Financier (CSSF) provides a comprehensive snapshot of the industry’s evolution and growth over this period. The dashboard’s numbers show how global capital is flowing into Luxembourg, thanks to its strong regulations, efficient operations and smart fund structures, cementing its place as a key hub for cross-border alternatives.

Market growth and composition

In just five years, Luxembourg’s AIF market expanded at an extraordinary pace, underscoring both investor confidence and the jurisdiction’s strategic positioning as a global hub for alternative assets.

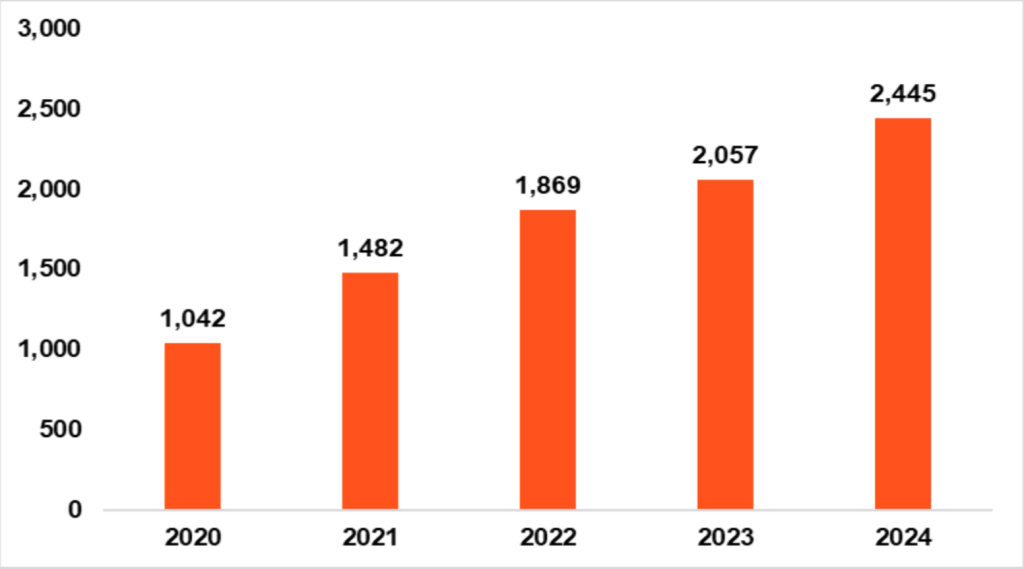

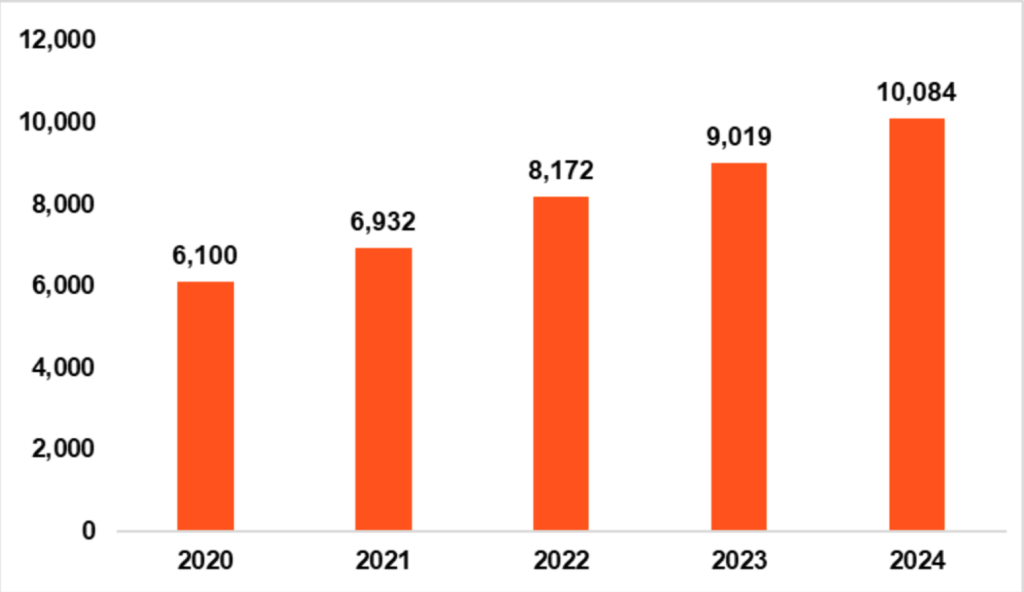

In 2020, the AuM of Luxembourg-based AIFMs stood at €1,042 billion, spread across 6,100 funds. By 2024, those figures had surged to €2,445 billion and 10,084 funds of funds.

Figure 1. Total AuM of AIFs domiciled in Luxembourg (in € billions)

Source: CSSF

Figure 2. Total number of AIFs domiciled in Luxembourg

Source: CSSF

This strong growth shows investors’ growing confidence and Luxembourg’s ability to scale its fund infrastructure to meet global demand.

Strategy composition and fund size: Then and now

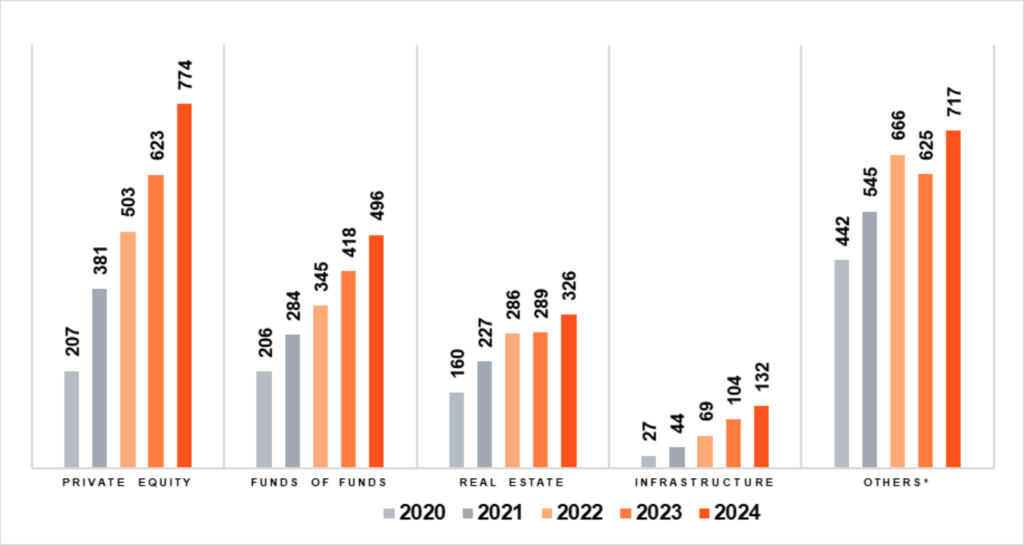

Private equity led the way, with AuM jumping almost 274%, from €207 billion to €774 billion.

Funds of funds followed with a 140.78% increase, growing from €206 billion to €496 billion. Meanwhile, real estate funds also posted strong performance, with AuM doubling from €160 billion to €326 billion, marking a 103.75% rise over the same period.

However, the most dramatic growth occurred in infrastructure funds, where AuM surged by 388.89%, from €27 billion to €132 billion—nearly a fivefold increase.

Figure 3. Total AuM of AIFs domiciled in Luxembourg, split by asset class (in € billions)

Note: *’Others’ includes equities, fixed income, commodities, hedge funds and other unclassified strategies.

Source: CSSF

A closer look at Figure 3 highlights how Luxembourg’s AIF landscape has shifted in both strategic focus and structural scale in the last five years: In 2020, private equity and funds of funds held roughly equal weight in terms of market share. However, by 2024, private equity emerged as the dominant strategy, accounting for 32% of total NAV (or approximately €774 billion), followed by funds of funds (€496 billion).

Structurally, the market retained its accessibility for smaller managers, with 61% of AIFs still below €100 million in AuM, although the average fund size increased to €242 million.

This shift shows two things: Luxembourg supports boutique and specialist funds, while growing to handle bigger institutional investments.

Institutional confidence, retail potential and liquidity resilience

Luxembourg’s AIF market remains overwhelmingly institutional, with 95% of investors classified as professional, including pension funds, sovereign wealth funds, insurers, and family offices. This institutional dominance reflects the jurisdiction’s credibility, regulatory clarity, and operational excellence.

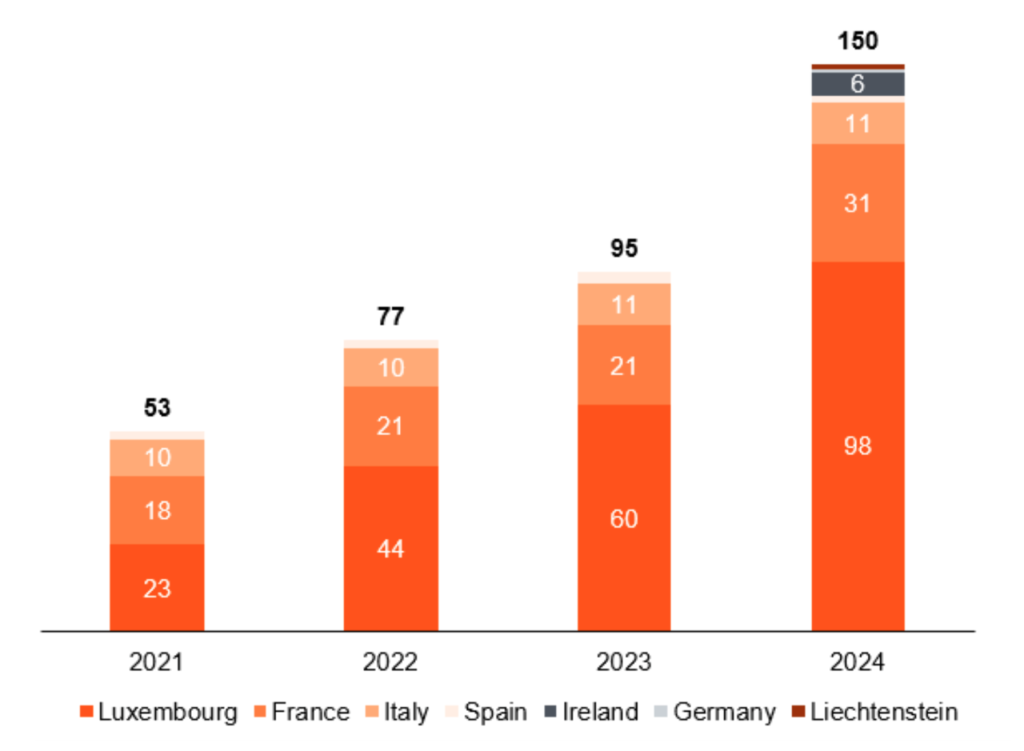

However, Luxembourg is also rapidly emerging as a key hub for European Long-term Investment Funds (ELTIFs), capitalising on the emerging ‘retailisation’ or ‘democratisation’ trend observed in the alternatives space. Indeed, ever since the ELTIF regime was amended in 2023 to make it more appealing for both asset managers and non-institutional investors, the number of ELTIFs domiciled in the Grand Duchy has increased significantly, jumping from 23 in 2021 to 98 in 2024, and making up 65% of all ELTIFs in Europe (Figure 4).

Figure 4. Number of ELTIFs by country of domiciliation

Note: Figures based on funds actively marketed at the end of each year.

Source: PwC Global AWM & ESG Research Centre, ESMA, Scope

Moreover, from a liquidity standpoint, the market continues to demonstrate discipline and resilience.

While most strategies tend to employ leverage to varying degrees, this is usually done at the operating level rather than at the fund-level, which makes them indirectly exposed to leverage albeit at manageable levels. Indeed, over the five-year period, overall leverage across Luxembourg’s AIF landscape remained limited, with the notable exception of hedge funds, which consistently disclosed higher leverage due to their reliance on derivatives and securities financing transactions such as repurchase agreements.

In 2020, financial leverage stood at €38 billion, representing a relatively small share of total NAV. Hedge funds were the primary users of leverage, with levels around 50% of their NAV, largely driven by unsecured borrowing and reverse repo transactions.

By 2024, financial leverage had increased significantly to €155 billion. Despite this rise, leverage remained modest relative to total NAV—again, except for hedge funds, where it reached approximately 62% of NAV. The increase was primarily attributed to the expanded use of secured borrowing and repo transactions.

Ability to adapt and attract

As investors look for long-term, resilient strategies in uncertain times, Luxembourg’s alternative investment scene has shown it can adapt and attract global capital.

The data from the CSSF’s 2024 AIFM Reporting Dashboard underscores a structural maturation of the market, one that has doubled in size, broadened in strategy, and deepened in institutional participation.

From private equity to infrastructure, Luxembourg has shown its capacity to serve as a scalable and credible home for alternative capital.

Importantly, Luxembourg’s evolution has not come at the expense of accessibility or stability. The market continues to support smaller, specialised funds while simultaneously enabling larger institutional mandates, striking a balance that few global hubs can achieve. In addition, ELTIFs are increasingly being seen as promising vehicles to open up alternatives to retail investors.

As institutional and retail capital increasingly converge, the Grand Duchy stands at the crossroads of global capital’s next frontier—where scale, regulation, and innovation meet.

Read more articles:

Luxembourg: M&A Activity Accelerates