The latest edition of Capgemini’s World Wealth Report—now in its 29th year—has landed, offering deep insight into global trends in wealth and wealth management among high-net-worth individuals (HNWIs). This year’s report presents a compelling narrative of shifting fortunes and emerging priorities, especially in Luxembourg.

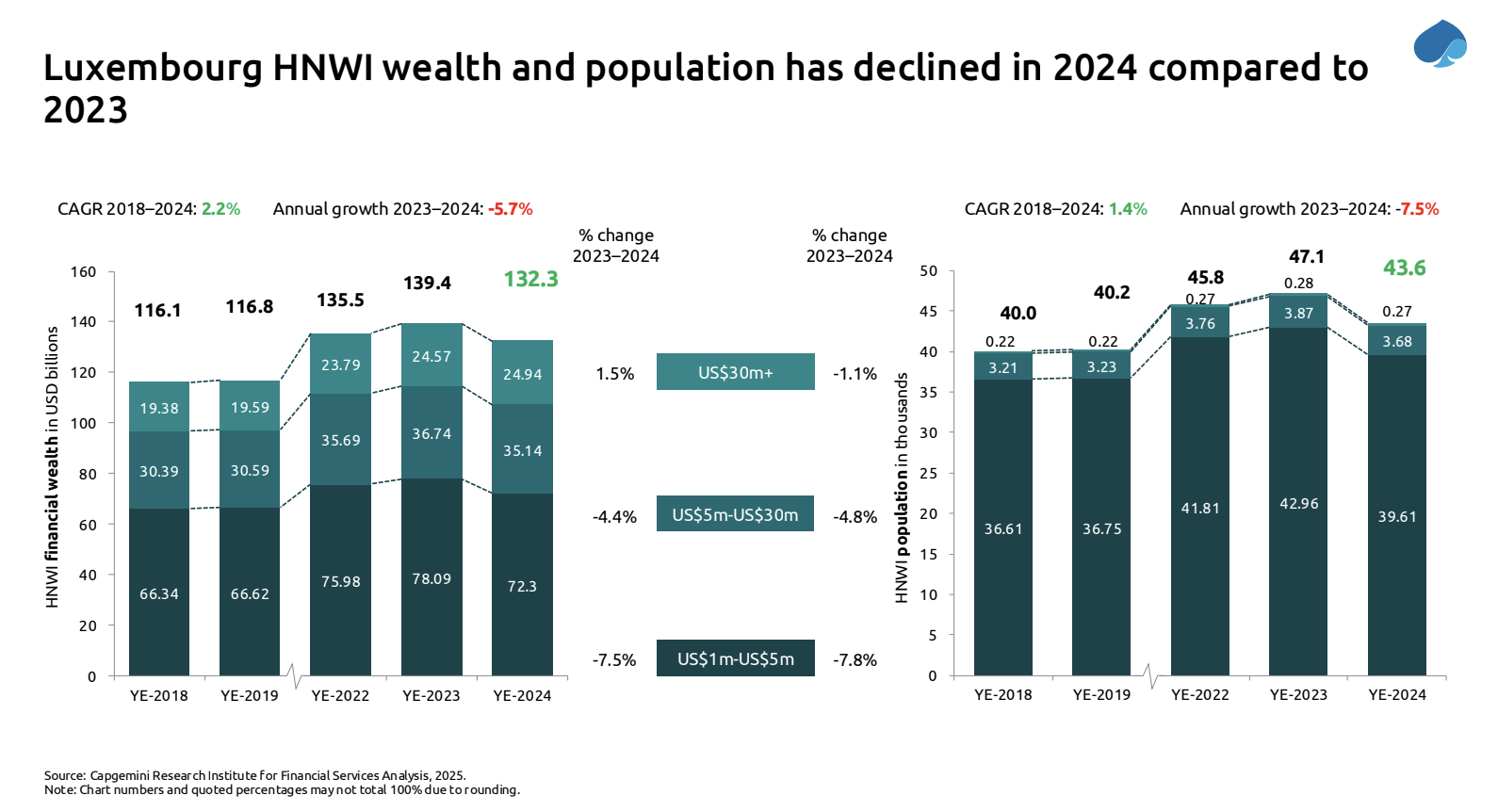

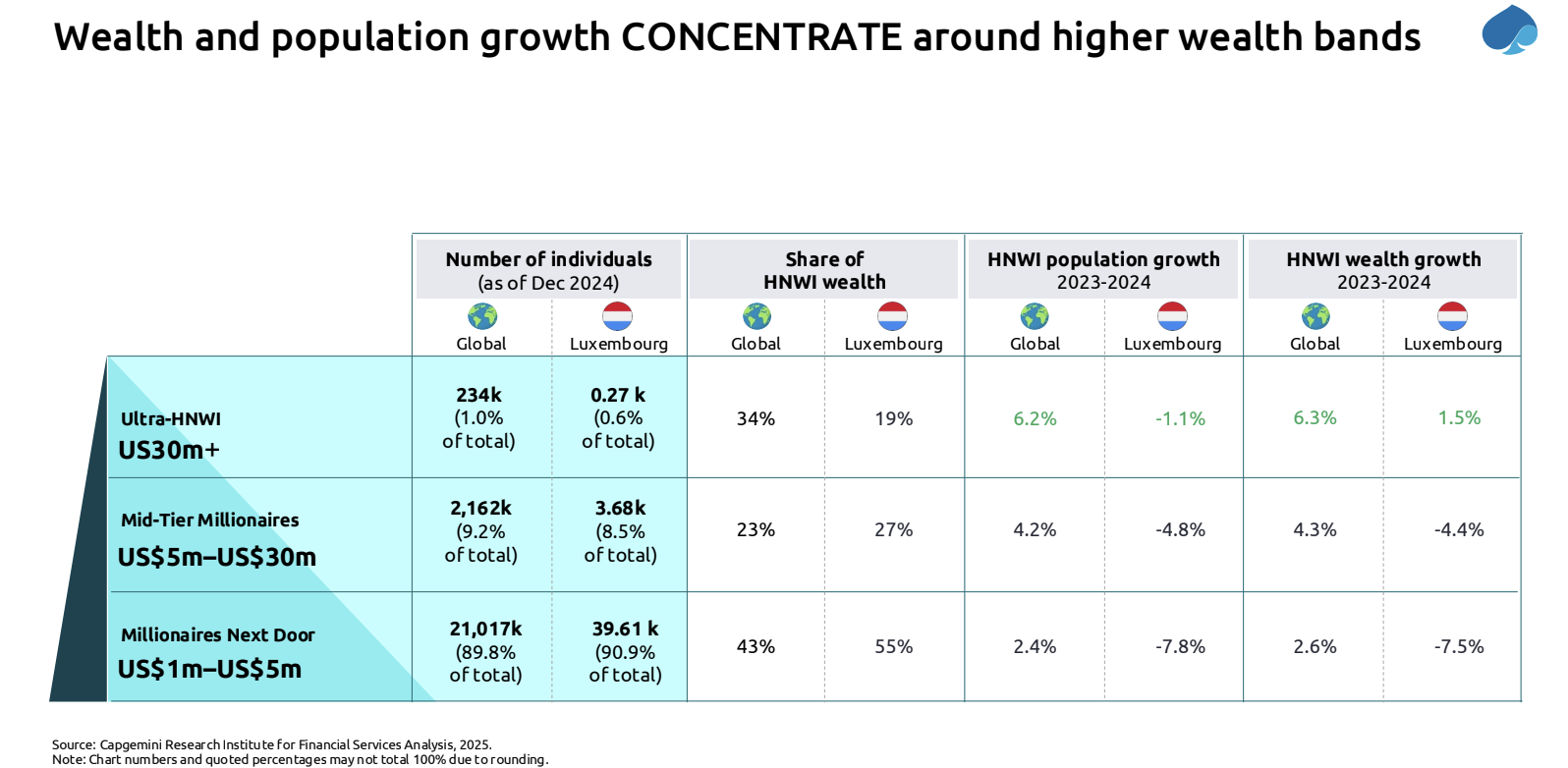

While global HNWI wealth has grown by 4.2%, Luxembourg is swimming against the tide. The total wealth of HNWIs in the Grand Duchy fell by 5.7% over the past year, and the local HNWI population has declined from 47,100 individuals in 2023 to 43,600 in 2024—a notable 7.5% drop.

In stark contrast, Luxembourg’s ultra-HNWIs—those with investable assets of $30 million or more—saw a modest wealth increase of 1.5%. Although this growth trails the global ultra-HNWI rise of 6.3%, it indicates resilience at the uppermost wealth tier.

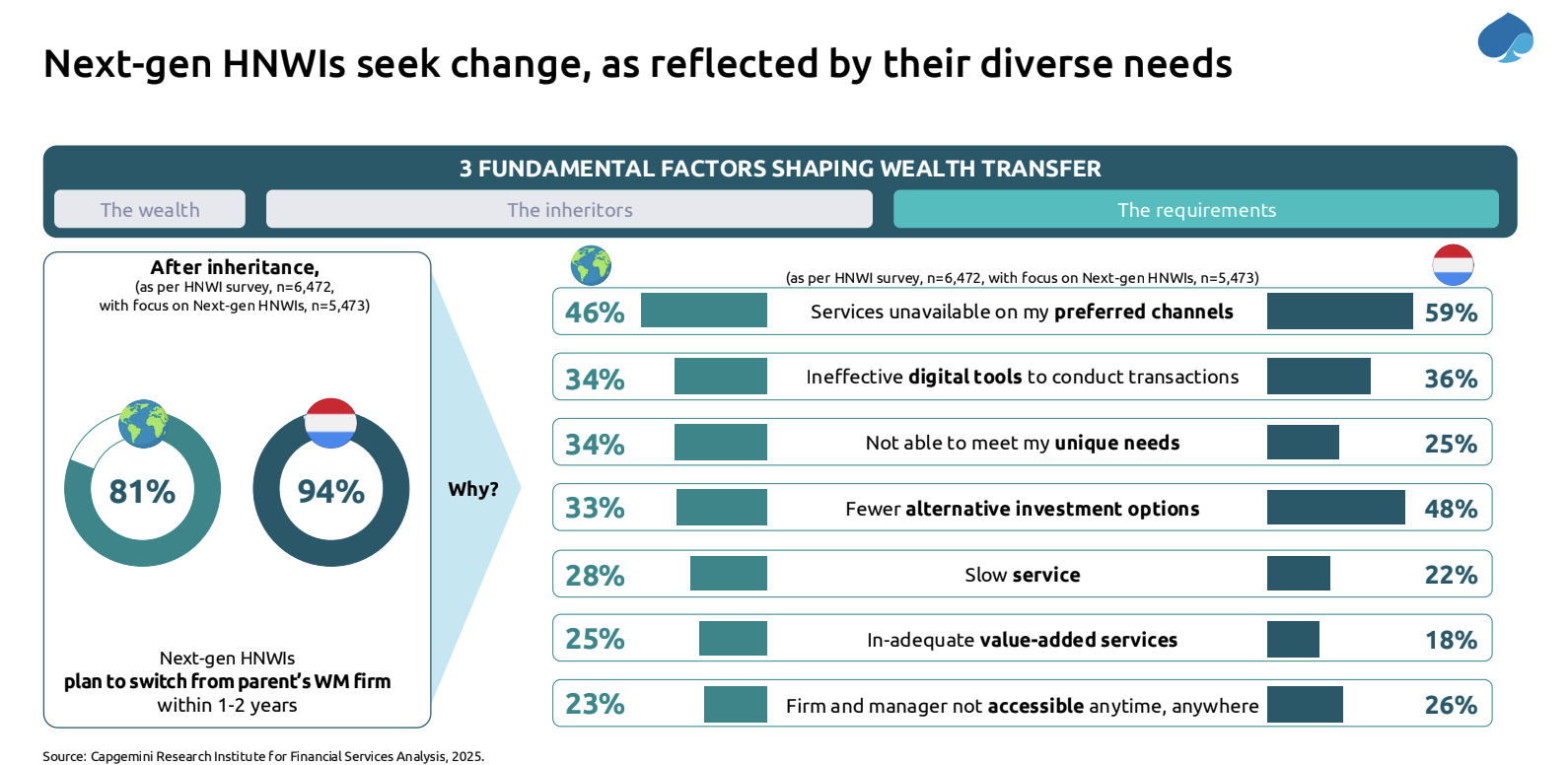

But the most transformative development lies ahead: the intergenerational transfer of wealth. Capgemini forecasts that by 2030, 32% of Luxembourg’s HNWIs will have received an inheritance, slightly ahead of the global average of 30%. By 2035, this number is expected to rise to 73%, again outpacing the global figure of 63%. By 2040, an overwhelming 87% of Luxembourg’s HNWIs will have inherited their wealth.

This transition signals more than just changing bank balances—it’s a shake-up for the wealth management industry.

“The next-generation of high-net-worth individuals arrive with vastly different expectations to their parents. This necessitates an urgent shift away from traditional strategies to effectively cater to their evolving needs on this wealth journey,” said Kartik Ramakrishnan, CEO of Capgemini’s Financial Services Strategic Business Unit and Group Executive Board Member.

Strikingly, 94% of Luxembourg’s inheriting HNWIs plan to switch wealth management firms following their inheritance. This compares to 81% globally, highlighting a notable dissatisfaction and opportunity gap within Luxembourg’s financial advisory ecosystem.

Capgemini’s presentation delves into what the next generation seeks: interest in private equity and digital assets such as cryptocurrencies, a continued appetite for offshore investments, and demand for both financial and non-financial value-added services. Preferences are shifting across service delivery channels as well, with more digital engagement and personalised interactions expected.

Crucially, relationship managers (RMs) will play a pivotal role in navigating this evolution. Yet, many firms appear unprepared. One in four RMs globally express dissatisfaction with their current tools for managing wealth transfers. In Luxembourg, that figure jumps to two in four—and all of them report intentions to leave their current firms within the next 12 months.

Kartik Ramakrishnan said: “Firms must also prepare to equip advisors with the digital capabilities, potentially augmented with agentic or generative AI, to mitigate the risk of losing both clients and key employees.”

For wealth management firms operating in or targeting Luxembourg, the message is clear: adapt or risk irrelevance in a rapidly changing landscape.

Read more articles:

Breaking The Glass Ceiling: Women CEOs In Luxembourg And The Future Of Leadership

Luxembourg’s CVC Powers Ligue 1 Transformation

Luxembourg’s tax System Goes Digital: From Paper Trails To Pre-Filled Returns