Is investing in your home still a reasonable choice in Luxembourg? How solid is the recovery of the real estate market? Nexvia explains.

After an extremely slow 2023 (40% fewer sales in the existing market), sales volumes kept increasing throughout 2024, bringing the total number of transactions for the year back to pre-2022 levels. This sustained recovery is confirmed for existing property in 2025, with a record number of transactions. Nexvia considers this recovery to be durable due to a new price balance found in the market.

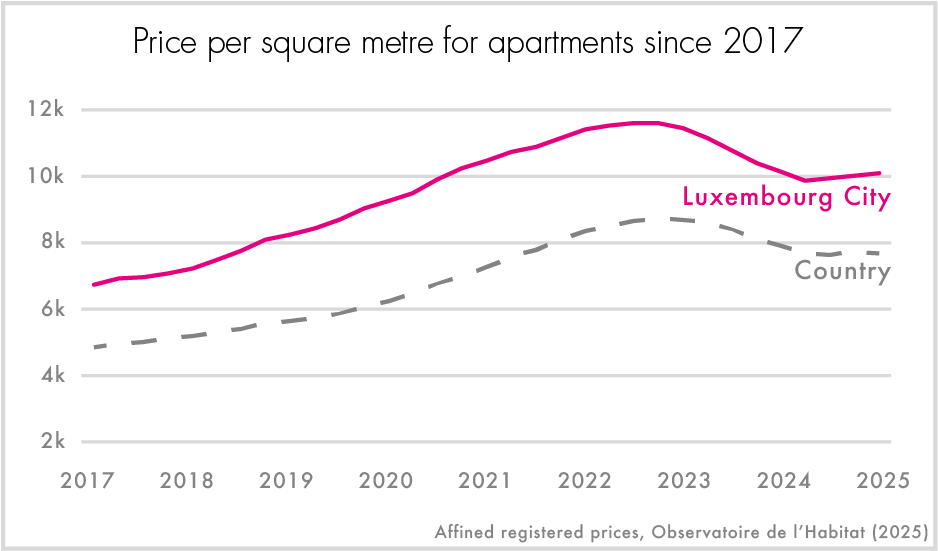

As a reminder, compared to its peak, prices fell by 21.5% for houses and 15.9% for apartments between mid-2022 and early 2024. It is important to note that they had doubled over the previous 10 years. This price correction, combined with the package of tax measures supporting purchases, has allowed the market to pick up again. However, the entrenchment of the “Bëllegen Akt” at €40,000 per buyer and the full deductibility of loan interest in the year of acquisition and the following year will continue to sustain demand for real estate, particularly among owner-occupiers and even more so among first-time buyers, who generally do not pay any registration fees at all.

Latest Data

Based on Nexvia’s exclusive transaction data obtained through its banking partnerships, prices increased by 2.7% in the first half of 2025 for apartment sales in Luxembourg City compared to the average price in 2024 (+1.9% for apartments outside the city and +2.0% for houses nationwide). In addition, the number of sales agreements signed in the existing market in the second quarter of 2025, as well as during the summer period, is very high. Off-plan supply however, still often poorly adapted to real market conditions in terms of price, conditions, or progress status, continues at this stage to push most buyers towards existing properties. This should continue to support the segment and the reasonable price increase underway, possibly at a level above inflation.

Finally, Luxembourg remains one of the countries in the world where buying becomes more profitable than renting the fastest. With only one condition: being able to allocate a nominally larger budget to buying than to renting a property. Our “Buy vs Rent” tool demonstrates mathematically that it is almost always more advantageous to be an owner after only 2 full years in a property.

And for those who have not yet exhausted the benefit of accelerated depreciation, real estate investment remains an attractive solution with a measured risk, given the shortage and undersupply of housing in our country. The key elements are to buy at a reasonable price and to have equity of around 25% of the property’s price.