SES’ $3.1 billion acquisition of Intelsat positions Luxembourg as home to Europe’s most powerful space infrastructure player, reinforcing both the nation’s and the company’s global influence. SES CEO Adel Al-Saleh explains.

In the East of Luxembourg, the SES headquarters at Betzdorf Château overlooks around 100 pristine white satellite dishes. The castle, acquired by SES in 1986, remains a symbol of the company’s pioneering spirit. Founded in 1985, SES transformed European broadcasting through Astra satellites, bringing direct-to-home television to millions.

Since 2024, CEO Adel B. Al-Saleh has been guiding SES into its next phase. At Betzdorf, he admits his summer was ‘not a good one,’ much of it spent on the $3.1 billion Intelsat deal that creates a combined fleet of 120 satellites and 4,000 employees, cementing Luxembourg as a European space hub.

“This is a very big deal for the industry,” Al-Saleh says. “Intelsat has been around for 60 years. SES has been around for 40 years. Together they bring 100 years’ experience to an industry changing at breakneck speed and evolving customer needs.”

Shifting demands come from airline business class and cruise line passengers who expect seamless connectivity, and government customers demanding specialised services. The cycles for developing new satellites are getting tighter to meet annual demand for new constellations and remain competitive. But Al-Saleh is calm. “By combining SES and Intelsat, we create a larger, faster, more capable competitor, with scale across fleets, engineering and ground networks,” he says. This isn’t just an acquisition. It’s a necessary step to compete in a market with a small number of players.

Multi-orbit advantage

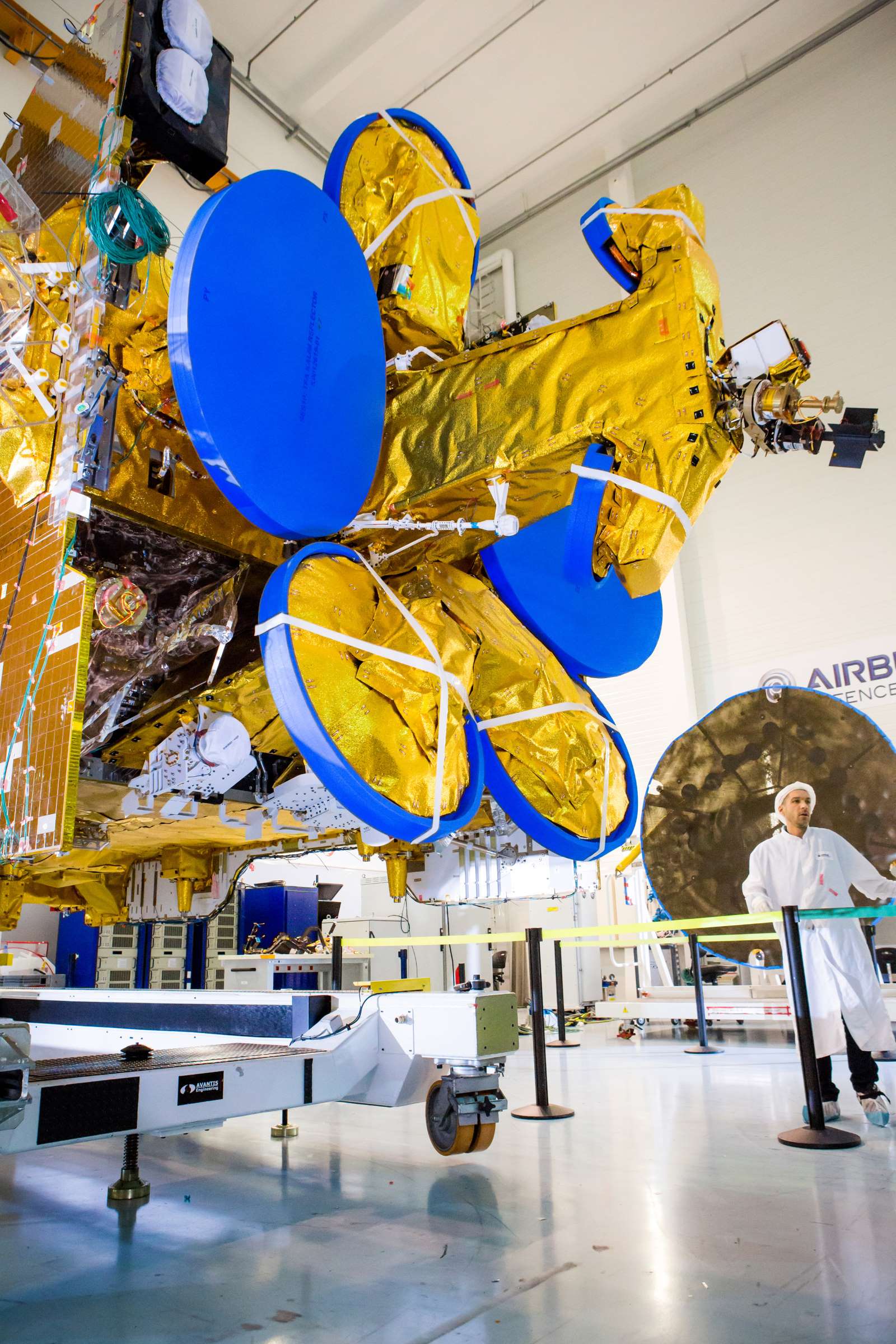

With Intelsat absorbed into its activities, SES boasts the largest geostationary (GEO: ie satellites which orbit in sync with the Earth’s rotation) fleet at 90 satellites. “People don’t see geostationary as a big future. We don’t agree with that,” says Al-Saleh. He cites the importance of GEO for large capacity applications in specific areas. These can be combined with its 30 Mid Earth Orbit (MEO) satellites and through utilisation partnerships in Low Earth Orbit (LEO) to serve ever more customers.

“People don’t see geostationary as a big future. We don’t agree with that”

Orbit is only half the story — SES is also investing heavily on the ground. “People think about satellites, as just the satellite, but there’s a big portion on Earth, the ground network, that you need to land these signals and to deliver them to where the customers need them… That’s why we will continue to invest in those areas.”

Space sovereignty for Europe

While SES is a Luxembourg success story, Al-Saleh frames SES as a European sovereign alternative for the world. “With the geopolitical dynamics… a lot of nations, and especially the European Union and the nations within the European Union are looking at themselves and beginning to think that they need to be building things so that they can be self-sufficient and be able to compete in the marketplace.”

SES will expand its GEO and MEO fleets with six new software-defined GEO satellites in 2026-28. It wants to have the largest MEO network in the world. “To support that, we need to invest in core technologies, ASICs [custom-designed microchips built to perform a specific function], payloads, buses [providing the core infrastructure that makes the satellite function] that are required to make the systems work.”

Boosted by the acquisition, SES expects to invest €600–€650 million annually in emerging segments and new technologies to explore new growth markets such as IoT, direct-to-device, inter-satellite data relay, space situational awareness, Earth observation and quantum key distribution

Al-Saleh expects strong growth in the government business segment as governments globally recognise the importance of sovereign networks and space as a critical component of defence. The firm has, meanwhile, reported double digit growth in the aviation and maritime verticals.

“We want to be a leader in the markets we select to serve […] government, media, aero, maritime and fixed data,” says Al-Saleh, adding: “We will evolve as a company to become a space company, not just a communications company.”

Emerging technologies

SES is exploring quantum encryption, inter-satellite communications, and space-based data centres. “Today, our payloads are becoming smarter and smarter.” Each O3b mPOWER satellite can generate thousands of beams connecting regions or aircraft.

In orbit edge computing, a way of processing data directly on satellites instead of sending everything down to Earth first, is already underway: “We’ve demonstrated […] to our customers that you can connect edge computing to the satellite, to provide that capability.” Depending on customer demand, in-orbit edge computing could reach the market within two years.

Inter-satellite connectivity enables LEO satellites to relay data via GEO and MEO satellites, ensuring near-constant communication with Earth instead of relying only on limited ground station contact. A 2024 SES-NASA demo proved this works, enabling real-time data transfer and creating new market opportunities.

And a Quantum key distribution satellite, used to create ultra-secure communication channels using quantum physics, is planned for 2026 through an ESA partnership.

A talent magnet

2025 marks the fortieth anniversary of SES, which began as a public-private partnership spearheaded by the Luxembourg government. Today the national satellite communications industry is well-established, and now part of a growing local ecosystem, thanks to Luxembourg’s 2016 launch of the Space Resources Initiative. The latter supports companies and research institutions in exploring and using space resources, further cementing the country’s reputation as a space powerhouse. Today, space contributes 2% of the country’s GDP.

Al-Saleh praises Luxembourg’s ecosystem: “Space is a priority for Luxembourg. They invest, they create environments that allow us to invest ourselves.”

And despite the battle for skilled staff, the CEO says that attracting international talent is straightforward. “We have about 600 people on this campus with 70 nationalities from all over the world. Speaking from experience it is quite easy for internationals coming in.”

“Being paranoid is really important, because that drives you and makes sure that you’re focused”

His playbook for SES’ transformation mirrors lessons from IBM and T-Systems: build diverse teams, adapt quickly, and never settle. “I’m a paranoid guy. Good is never good enough. Success is never lasting. […] Being paranoid is really important, because that drives you and makes sure that you’re focused.”

From operator to solutions leader

Part of this laser focus has recently turned to the company’s branding and visual identity. In September 2025, the firm released The Orb, a new logo referencing its global reach and multi-orbit operations. The distinctive purple colour, inspired by the Northern Lights, was chosen for its uniqueness in the industry. Internally, there is also a major shift in how SES describes its activities, the biggest one being that they no longer consider themselves a satellite operator, but a space solutions company.

Under the new company tagline: “Solve. Empower. Soar.” (a play on the company name SES), SES is set on playing a major role in creating a future of seamless integration of terrestrial and space networks. A place where, like Al-Saleh, the connectivity is “always on”.

“10 years from now, space will be completely integrated into our normal life. We wouldn’t even know whether we are using space or terrestrial networks […] You’ll never be disconnected,” he says.

“10 years from now, space will be completely integrated into our normal life”

To get there requires strategy. For SES that means investments into a multi-orbit infrastructure, serving governments, media, mobility and enterprise customers worldwide while ensuring European sovereignty. “Europe must have its own secure space capability. SES is ready to provide it. We are a European company with global reach — and that matters.”

Read more articles:

Luxembourg: Autonomous Mobility Testbed

The Giorgetti Gamble: Will GRIDX Redefine Experience In Luxembourg?

Luxembourg’s Paradox: World-Class Health, But A Generation At Risk